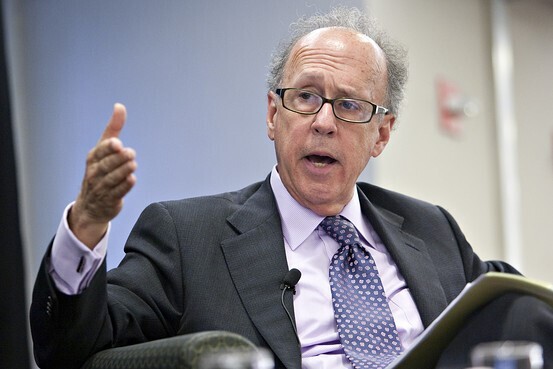

Stephen Roach, the former Chairman of Morgan Stanley, Asia, has publicly pronounced "Hong Kong is over." Roach, now an analyst focusing on the economy of the former British Crown Colony, which is presently a special administrative zone of China, highlights Law 23 as its primary concern.

This law subjects Hong Kong to stringent Chinese security measures and criminalises even verbal criticism of Beijing or the government. Once a thriving metropolis in Asia, Hong Kong is mired in deep pessimism as a profound malaise takes root.

Hong Kong's famous stock market languishes in stagnation while housing prices plummet, and an exodus of talent exacerbates the brain drain in both scientific and economic sectors. Many upscale establishments, including restaurants, bars, spas, and shopping malls, have relocated from Hong Kong to the more alluring Shenzhen across the Chinese mainland. Notably, clientele from Hong Kong frequently migrates to Shenzhen for business meetings and dining experiences, drawn by the comparatively relaxed security measures that foster open dialogue and discourse.

The significance of Hong Kong as a financial hub is diminishing

One of the initial significant repercussions of this unrest is the severance of direct data connections between foreign corporations, including international law firms, and their branches in Hong Kong. This strategic move complicates efforts by Chinese security authorities to monitor internal discourse on the evolving situation within these foreign entities. Several German companies operating in Hong Kong have also adopted these precautions.

Moreover, some firms are taking even more drastic measures, downsizing their Hong Kong operations, and relocating critical functions to other Asian hubs, notably Singapore and Tokyo. Consequently, Hong Kong has relinquished its standing as the world's third-largest financial centre, now trailing behind Singapore in third place, following New York and London. Further declines are anticipated in the foreseeable future.

Hong Kong's once-thriving harbour, renowned as a premier container port facilitating the shipment of Southern China's industrial exports to global destinations, is now eclipsed by Shenzhen's larger and more contemporary facilities. This shift has seen an increasing number of shipping lines diverting their vessels to Shenzhen, diminishing Hong Kong's prominence in the maritime industry.

Similarly, the Hong Kong Exchange and Clearing (HKEX) conglomerate faces challenges, witnessing a decline in mainland Chinese and international companies opting to list their shares for global trading on its platform. Consequently, HKEX has also seen a wane in its appeal to foreign professionals, with many either voluntarily departing or being compelled to do so. HKEX predominantly comprises Chinese personnel from both Hong Kong and the mainland.

However, these issues are not isolated occurrences.

LME future uncertain

The Hong Kong Exchanges and Clearing Limited (HKEX) holds a significant position as an exchange, encompassing a crucial group of companies, notably the London Metal Exchange (LME), which stands as the foremost metal exchange globally. There's widespread discourse regarding the LME's future, spurred by uncertainties surrounding Hong Kong's situation and its potential impacts on metal trading, particularly on the LME.

Acknowledging China's ownership of the LME and its paramount role as the world's largest metal consumer and producer, including overseeing major mining companies abroad, adds complexity to the discussion. China's substantial share in global steel (55 per cent) and aluminium (59 per cent) production underscores its influence in the metal market. In Hong Kong, where aluminium, nickel, and copper hold significant interest due to their extensive consumption in China, concerns mount regarding potential crises akin to the recent nickel debacle at the LME.

Moreover, the intersection of China's export strategies and LME's metal trading presents further challenges. China's aggressive steel export drive, characterized by low prices, intersects with global trade dynamics. This has prompted manufacturers to adjust their strategies, focusing on lower-quality steel products, which find buyers in countries with robust steel production like Japan. Though steel differs from aluminium, the possibility of manipulative measures akin to those witnessed in the steel sector looms over aluminium, nickel, and copper markets.

The evolving political landscape, with increasing Chinese mainland influence over LME's owners, raises apprehensions regarding potential interventions in metal trading. This uncertainty underscores the difficulty of anticipating China's response to future metal crises.

Responses