India: ADC12 aluminium alloy ingot prices remain stable w-o-w

Prices of aluminium ADC12 alloyed ingots remained stable w-o-w across both northern and southern regions in India, largely due to ongoing sluggish demand in the automotive sector and a weakened export market.

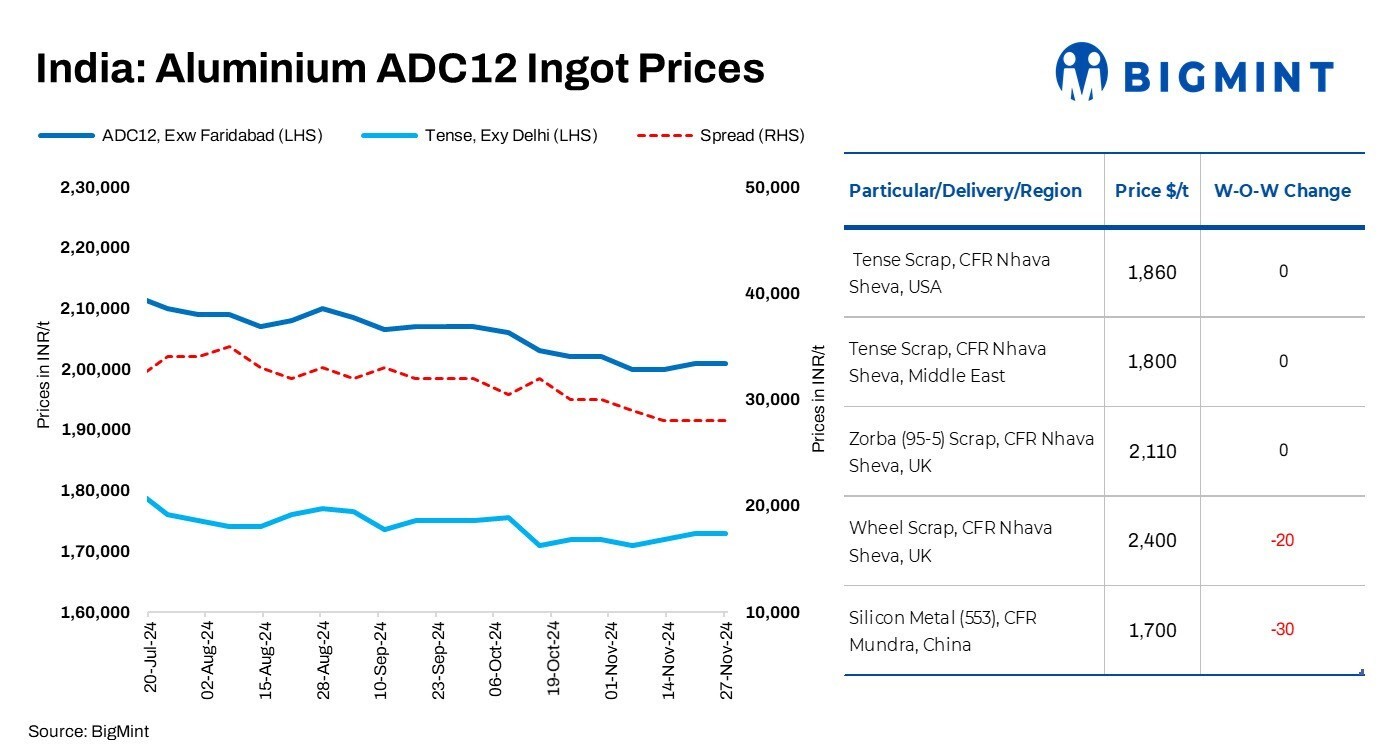

BigMint's weekly assessments for ADC12 (non-OEM) grade stood at INR 201,000/tonne (t) in Delhi and INR 203,000/t in Chennai, stable w-o-w.

Last week, aluminium prices surged after China announced the elimination of export tax rebates on aluminium and copper semi-finished products, effective 1 December 2024. The rebate will decrease from 13 per cent to nil. This announcement drove LME aluminium prices to a six-month high above $2,700/t.

At the time of reporting, three-month aluminium futures on the LME stood at $2,610/t, down marginally by 1% compared to the previous week's levels of around $2,644/t. Meanwhile, stocks at LME-registered warehouses were at 703,475 tonnes, falling by 1 per cent from 711,400 tonnes the previous week.

The current scrap-to-semi-finished spread stood at INR 28,000-29,000/t, stable w-o-w.

Additionally, a subdued automotive sector weighed on market activity. Recently, a leading automaker set its December ADC12 settlement price at INR 209,000/t, down INR 900/t from November, marking a nine-month low. The reduction reflects ongoing weak demand in the auto sector. Alloy ingot producers warn that further cuts could pressure margins by narrowing the price gap between Tense and ADC12.

Imported raw material prices stable w-o-w

The basic raw material prices for aluminium alloys, that is, scrap, remained largely stable w-o-w. BigMint's assessment for tense scrap originating from the UAE was at $1,800/t CFR Nhava Sheva, which is stable w-o-w. Meanwhile, Zorba 95/5 from the UK stood at $2,110/t CFR west coast, India, steady w-o-w.

China's silicon offers decline

According to BigMint's assessment, China's 553-grade silicon prices dropped by $30/t w-o-w to $1,700/t CFR Mundra. Meanwhile, offers from the suppliers' side were at $1,750-1,770/t. However, bids were heard lower, at $1,670-1,680/t.

Export market remains subdued

The ADC12 export market has slowed significantly, with shipments to Japan not yet occurring due to weak demand. Recent offers from India to Japan stood at $2,350/t. According to sources, exports from India to Japan are expected to begin gradually.

The global market for ADC12 remains sluggish amid weak demand. However, sources report that China has been actively importing aluminium ADC12 ingots from Thailand, driven by competitive pricing and duty exemptions.

Domestic scrap prices stable

In the domestic market, Tense scrap prices remained steady w-o-w in both Delhi and Chennai, while other grades witnessed a downtrend. According to BigMint's assessment, domestic Tense scrap stood at INR 173,000/t ex-Delhi NCR and INR 174,000/t ex-Chennai.

Outlook

Aluminium ADC12 prices are expected to remain range-bound in the short term, as the auto sector is yet to regain momentum. However, year-end destocking may lead to a rise in trade activities. Additionally, overseas demand for ADC12 will likely remain slow due to the upcoming winter holidays.

Received under the content exchange agreement with BIGMINT

Top image credit: Aluminium Machinery Solution Provider

This news is also available on our App 'AlCircle News' Android | iOS