Alcoa Corporation delivered a robust financial performance in the first quarter of 2025, marking a sharp turnaround from the prior year and a solid improvement over the previous quarter. Net income more than doubled sequentially, driven by higher aluminium prices, effective cost management, and strategic operational decisions. Despite slight revenue contraction and new US tariffs on Canadian aluminium, Alcoa’s performance reflected operational resilience and smart capital moves.

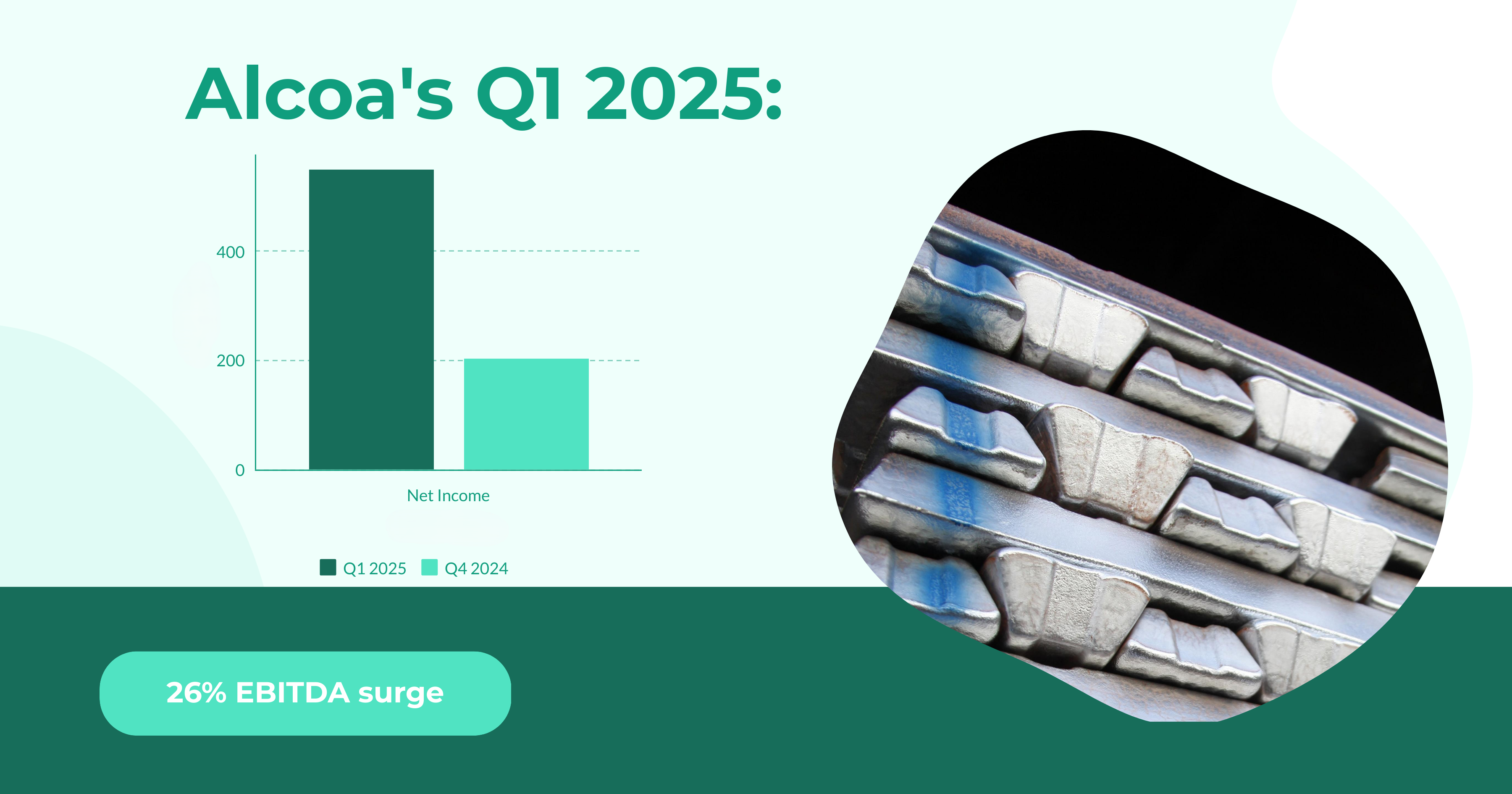

Alcoa posted a net income of USD 548 million (USD 2.07 per share) in Q1 2025, up 171 per cent from USD 202 million in Q4 2024 and a stark reversal from the USD 252 million loss in Q1 2024. Adjusted net income reached USD 568 million (USD 2.15 per share), showing a 106 per cent increase from the prior quarter.

Adjusted EBITDA excluding special items rose to USD 855 million, up 26 per cent sequentially and over sixfold from USD 132 million a year earlier. These gains were mainly due to stronger aluminium pricing, lower alumina costs, and improved bauxite offtake and pricing arrangements.

Alcoa’s revenue slipped 3 per cent quarter-over-quarter to USD 3.37 billion due to lower alumina and aluminium shipments. Alumina third-party shipments declined 8 per cent, and aluminium shipments dropped 5 per cent, which was largely tied to shipment timing and the absence of Ma’aden offtake volumes.

Yet, margin expansion was significant. Net income margins jumped to 16.3 per cent, up from 5.8 per cent in Q4 2024, thanks to favourable commodity pricing and the absence of main restructuring costs seen in late 2024.

A key challenge in Q1 was the reimposition of US Section 232 tariffs on Canadian aluminium, effective March 12. Alcoa incurred USD 20 million in tariff-related costs, which partially offset aluminium segment gains.

Aluminium segment operating costs per metric ton increased to USD 2,775, up from USD 2,675 in Q4 2024. The rise was largely due to the expiration of a USD 30 million benefit from the US Inflation Reduction Act. In contrast, alumina production costs stayed flat at USD 312 per tonne, while production volumes declined 1 per cent to 2.35 million tonnes.

Two strategic actions marked the quarter, wherein one was Alcoa’s finalisation of a joint venture with Spain-based IGNIS Equity Holdings to support the restart of its San Ciprián smelter, effective March 31, 2025. Alcoa contributed USD 81 million for a 75 per cent stake and management control, with the aim of bringing the smelter back online in 2025. The other one was Alcoa’s repositioning of the debt. The global business issued USD 1 billion in senior notes via its Australian subsidiary while retiring nearly USD 890 million in existing debt. The move lowers near-term liabilities and aligns capital with global operations.

Cash flow from operations was USD 75 million, down significantly from USD 415 million in Q4 2024, reflecting higher working capital and seasonal payment patterns. Free cash flow was slightly negative at -USD 18 million, but the company still ended the quarter with USD 1.2 billion in cash and a stable net debt position of USD 1.49 billion.

For the alumina segment, EBITDA fell from USD 716 million in Q4 2024 to USD 664 million, mostly on lower sales volumes and pricing. Still, the alumina segment benefited from the non-recurrence of inventory write-downs from late 2024.

Meanwhile, EBITDA dropped to USD 134 million for the aluminium segment from USD 194 million, with shipment declines and tariffs dragging down results. However, realised third-party aluminium prices increased to USD 3,213 per tonne, up from USD 3,006.

“Approximately 70 per cent of our aluminium produced in Canada is destined for US customers and is now subject to 25 per cent tariff costs ... Currently, the net annual result is approximately USD 100 million negative for our business,” CEO William Oplinger said during a post-earnings conference call.

Looking at Q2 2025, Alcoa projects continued strengthening the alumina segment, expecting to maintain current EBITDA levels. The aluminium segment, however, faces uncertainty with geopolitics interfering with business, such as tariff costs being projected to rise to USD 90 million in Q2 and restart expenses for San Ciprián to add another USD 15 million. Then, there are also favourable alumina cost changes that may offset some pressure, expected to save USD 165 million. The company maintains its full-year guidance for production and shipments in both alumina (9.5 - 9.7 million tonnes) and aluminium (2.3 - 2.5 million tonnes).

Responses