Introduction:

The year 2018 has seen some unprecedented developments in the global alumina and aluminium market scenario that has turned the market upside down making all previous forecasts redundant. The alumina market went through a topsy-turvy and volatile period with sharp rise and fall in prices and supply disruptions. The almost balanced market in the beginning of 2018 after the environmental capacity cuts turned to a deficit market in the second quarter leading to a sharp increase in prices. Supply tightness and uncertainty created panic in the market. Though towards the end of 2018, the prices started consolidating, the supply side uncertainties still continue to persist. Read through the article that sketches the development in the alumina industry over the year 2018.

{alcircleadd}

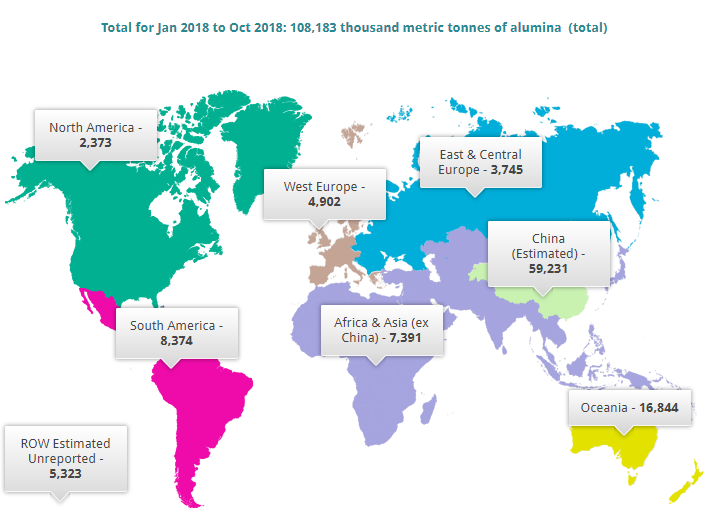

YTD production of alumina (January – October) stood at about 108 million tonnes in 2018, in comparison to 112 million tonnes in YTD 2017. For the whole year of 2017, alumina production stood at about 126 million tonnes. The drop in production was mostly driven by capacity cut in Alunorte. China’s alumina production stood at 60 million tonnes for the same period.

According to Beijing Antaike, China's total alumina production capacity is expected to reach 86 million tonnes in 2018, up from 81 million tonnes in 2017. Actual alumina output was expected to total 74 million tonnes in 2018, up from around 70 million tonnes in 2017, the analyst firm said.

New Investments and Expansions:

Emirates Global Aluminium (EGA) has announced the completion of commissioning process of the calcination section of its alumina refinery at Al Taweelah in Abu Dhabi. Al Taweelah is equipped with two calciners, each of which will have a capacity to produce 3,500 tonnes of alumina daily. The commissioning of the other sections of the alumina refinery is taking place in time and the refinery is expected to produce its first batch of alumina by H1 2019. Once complete, the refinery will produce 2 million tonnes of alumina per year.

Aluminum Corporation of China Limited (Chinalco) on September 17, announced its plan to invest some RMB 5.81 billion to construct a new alumina project in Fangchenggang of Guangxi province. The project on completion will be reportedly having an annual capacity of 2 million tonnes.

Vedanta Ltd’s proposal for expansion of Lanjigarh alumina refinery was recently cleared by the High-Level Clearance Authority (HLCA), the apex body to approve investments in Odisha. The company plans to expand the capacity to six million tonnes per annum from its current 1 million tonnes.

Utkal Alumina International, a fully-owned subsidiary of Hindalco, declared on July 4, that it would most likely finish its 500-kilotonne expansion over the next 30 months. This project involves a capital outlay of INR 1300 crore.

Nalco announced it would invest INR 7000 crore to INR 12000 crore to set up a 1.4 million tonne or 2 million tonne alumina refinery in Vishakapatnam.

The Twist and Turns in the Market:

The supply scenario of alumina was disrupted by one major happening in the beginning of 2018. The fifty per cent capacity closure in Hydro’s Alunorte refinery in Brazil in March on the issue of bauxite residue pond leakage created panic in the market lifting the prices. Environmental regulators claimed that water from bauxite residue pond was released from the waste impounds of the mine and refinery after heavy rainfall in February, resulting in the initial shutdowns. Following orders from federal, state and local authorities in Brazil on the issue of bauxite residue pond leakage from its DRS2 bauxite residue deposit, Hydro had to close its DRS2 bauxite residue deposit in March and cut the alumina production capacity by 50%.

Image: Reuters

Image: Reuters

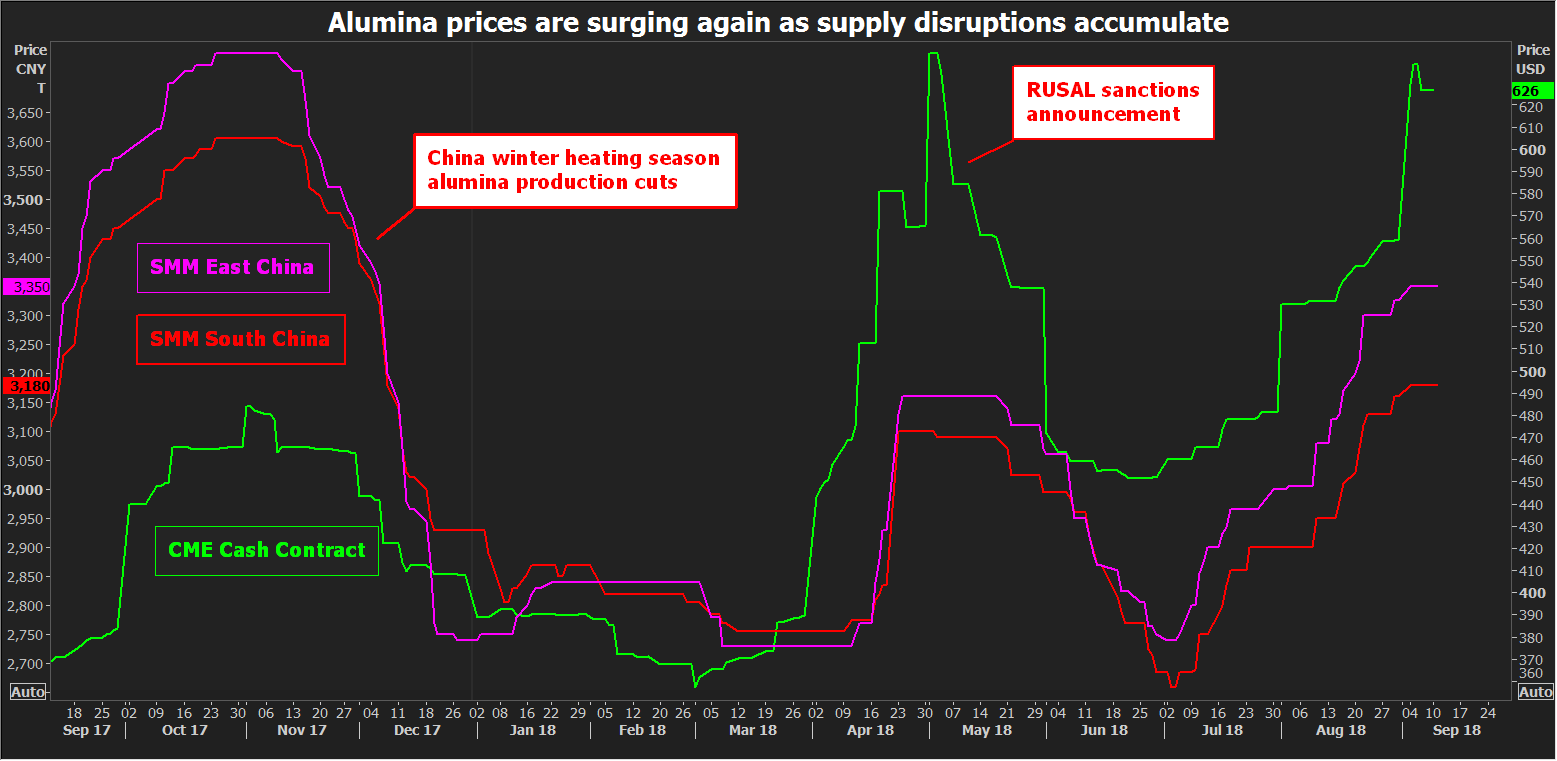

Prices were taken to an unforeseen level when, Trump administration imposed punitive sanctions on Rusal and its owner Oleg Deripaska on April 7 and following it, London Metal Exchange suspended Rusal’s aluminium from April 17.

Rusal accounts for about 14 per cent of world aluminium production outside China. The company not only supplies about 6.5 % of global aluminium demand but also supplies about 7 per cent of the world’s alumina, with plants in Ireland, Jamaica and a 20 per cent stake in Rio Tinto’s giant refinery in Queensland, Australia. Spot alumina price saw some unprecedented highs in 2018 first half and doubled to over $700 per tonne as the market showed panic reaction to U.S. sanctions on Rusal in April and Alunorte’s 50% capacity cut.

The sanctions put the future of Rusal’s Aughinish alumina plant in doubt, which is Europe's largest alumina refinery in Ireland and a major alumina asset of RUSAL contributing about 30 per cent of alumina produced in the EU.

Around 1,500 of its 1,600 workers at Alcoa’s Wagerup, Pinjarra and Kwinana refineries and the Huntley and Willowdale bauxite mines walked out of work on August 8 over a new workplace agreement. The walk-out at the refineries has injected yet more uncertainty into an already problematic supply equation.

Current Solutions:

On September 28, approximately 1,600 employees represented by the Australian Workers’ Union ended a strike at three alumina refineries and two bauxite mines. Production continued with limited capacity during the strike. The refineries affected by the strike were the Kwinana, Pinjarra, and Wagerup refineries with capacities of 2.2 million tpy, 4.2 tpy and 2.6 tpy respectively.

On October 3, Norsk Hydro ASA announced that it would shut down all production in Alunorte alumina refinery and the nearby Paragominas Mine in Brazil. On October 8, the environmental regulator permitted the restart of one-half of the refinery’s capacity. Norsk Hydro continued to seek permitting for the use of its new red mud impoundment area in order to return the mine and refinery to full production capacity. In order to resume full output at the 6.3m tonne a year alumina refinery, Hydro needs a Brazilian court to lift the five production embargoes. According to the latest update, Brazilian expert study showed that there was no overflow from Alunorte’s residue deposit areas DRS1 and DRS2 in February 2018. The study indicated it can produce at its nominal capacity of 6.3 million tonnes of alumina a year. The refinery is expected to start full production by the second quarter of 2019.

Graham Kerr, mining group South32’s chief executive said it would still be “difficult” for the Alunorte refinery to return to full production this year.

The end of the year brought some more relief to the alumina market as the US treasury announced its intention to remove sanctions against Rusal on December 19. Rusal’s parent company had been negotiating with the US Treasury to free itself from the sanctions. US Treasury after extending the deadlines for the full imposition of sanctions twice announced it would remove sanctions against Oleg Deripaska-owned Rusal. The Irish foreign ministry said in a statement that the Aughinish Alumina plant would be free from the threat of sanctions following a 30-day Congressional review period.

The Ministry of Industry and Information Technology in China said on its website in the first week of August that China would continue output cuts in the domestic alumina/aluminium sector during the winter heating season (November 15-March 15). According to a later report, China has opted not to enforce a repeat of blanket 30 per cent output curbs on aluminium and alumina output in 28 northern cities this winter. This winter’s cuts are to be decided by individual cities and a few smelters are closing capacity due to lower profit margin. However, there has been no major alumina capacity cut in China.

Alcoa will have about 300,000 tonnes of surplus alumina to sell next year as they closed 2 smelters in Spain which will add to the total alumina supply.

Price Movements and Impacts on Aluminium Producers

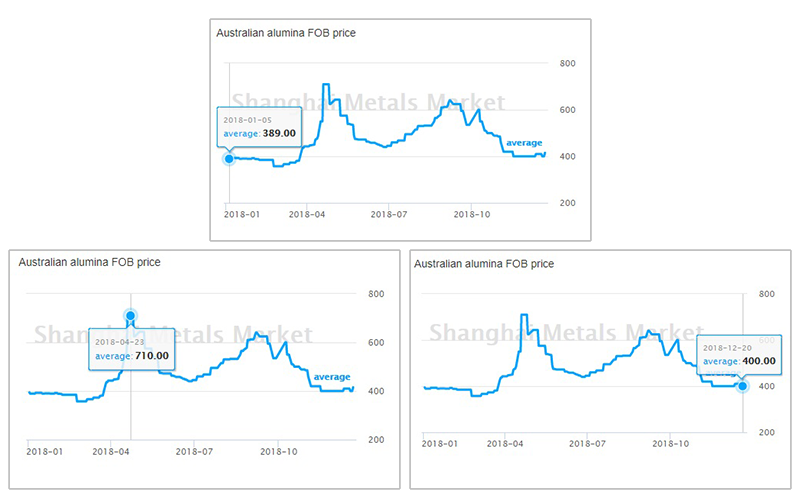

The temporary closure of Hydro’s Alunorte alumina refinery in Brazil and uncertainties surrounding U.S. sanction on Rusal pushed up alumina price sky high driving the export market. While the monthly average Australian alumina FOB price started the year with about US$ 390 per tonne and after the happenings in March and April, Australian alumina FOB price shot up to US$ 710 per tonne in April 2018. Though prices started consolidating, the strikes in Western Australia and anticipation on China’s winter capacity cut pushed the prices higher again to about US$ 640 per tonne in the beginning of September.

The current Australian alumina FOB price stands at US$400 per tonne, down about 33% from September prices of US$ 640 per tonne and about 44% from the highest in April.

According to Shanghai Metals Market, in China average spot alumina prices dropped to RMB 3013(US$479) per tonne in December from RMB 3321 per tonne (US$ 488) in September 2018. In East China market, the highest alumina producing region, prices now stand at RMB 3030 (US$488) per tonne, down from RMB 3350 per tonne (US$ 488) in September 2018, the highest since December 2017.

According to Nalco, in Q2 CY 2018, the average price realisation for alumina was US$555 per tonne. It is quite high and in Q3 CY 2018, alumina prices stood at around US$550 per tonne. Nalco drives the alumina export segment in India every year being the top alumina producer and exporter. According to sources, the Nalco’s recent tender for 30,000 tonnes of alumina went to EGA for US$488 per tonne. Vinacomin is expected to settle its mid-November bids at around US$435 per tonne.

Industry analysts for bauxite and alumina forecasted an average API price of US$425 per tonne for 2019. This may go down if Alunorte comes on stream in full capacity by January 2019.

Higher demand and price for alumina and manganese lifted South32 annual profit by 16% in 2018. Alumina Limited, another aluminium producer reported that net profit grew 110% in H1 2018 on higher global alumina prices.

The tight alumina market pushed up costs for global producers of the lightweight metal in 2018 keeping aluminium prices high. Most of the aluminium producers with their own alumina refineries are earning profit, while aluminium makers that buy alumina are under pressure due to cost increase.

Trade Focus: China Became an Exporter of Alumina

Overwhelming alumina prices and supply concerns drove alumina export from India, China and Vietnam in the first three quarters of CY 2018.

According to China Customs data, China's exports of alumina increased more than fivefold MoM in September to 166,000 tonnes, the highest monthly volume in 2018. The country's year-to-date exports of alumina exceeded imports for the first time this year. China imported 30,000 tonnes of alumina in September, customs data said. China has finalized orders for the rest of this year for at least 100,000 tonnes of alumina per month.

According to the data released by the General Administration of Customs on Friday, November 23, China’s October alumina exports exceeded 460,000 tonnes and reached the highest since at least October 2014. The reason because Chinese producers of the aluminium raw material continued to cash in as much as possible on the global shortage. The customs data also shows that China so far in 2018 has exported just under 1 million tonnes of alumina.

After the publication of Q1 2018 results, Nalco CMD TK Chand said alumina business is pushing up Nalco profitability. He said the PBT from alumina segment stood at INR 1125 crore. Nalco drives the alumina export segment in India every year being the top alumina producer and exporter. The company during the first half of FY 2018-19 recorded a turnover of INR 5952 crore, up 42 per cent from the corresponding period last year. The net profit went up from INR 364 crore in H1 of the previous fiscal to INR 1197 crore this year.

Conclusion

The lowest level the alumina prices have touched in 2018 was about US$ 370 per tonne and the level is not expected unless all current supply disruptions come into place. Forecasting alumina prices for the medium term continues to remain risky due to the volatility in the market. It remains to be seen how the key players wrap up their operational issues in the first quarter of 2019. The market looks cautiously bullish as the floor for the alumina price has now been raised and producers will protect their prices for 2019. Hydro expects to restore operations at Alunorte to full capacity in the first or second quarter of 2019. If supply side disruptions come to an end, the alumina market would remain well supplied for 2019 and prices should stay around $400 per tonne.

Responses