The publicly listed company on the Australian Securities Exchange, Alumina Limited’s forecast toward demand for alumina soon to surplus supply is creating possibilities to bring back the agenda of the expansion of two alumina refineries in Western Australia.

The growth signals came when the company stated that it was examining ways to release more franking credits to shareholders.

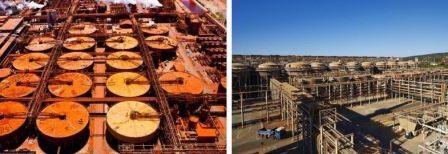

Alumina Limited labelled proposal two years to invest hundreds of millions of dollars for the expansion of its Wagerup and Pinjarra alumina refineries south of Perth, but in early 2020 it holds back the feasibility studies due to the deadly Covid-19 pandemic attack.

The supply of alumina surpassed demand, meantime with the benchmark price for the commodity fetching $US276 per tonne on 25th May 2021, which is less than half the record price of $US600 per tonne in mid-2018

Mike Ferraro, Managing Director of Alumina Limited said: “The global alumina surplus of 2.9 million tonnes would be absorbed by the end of the year and prices were more likely to rise than fall.”

Ferraro predicted: “Demand for alumina – the main feedstock for aluminium – would exceed supply for much of the next four years.”

“We think outside of China there will be a demand for about 7.8 million tonnes of [extra] alumina between now and 2025, we don’t readily see where all that additional production is going to come from,” he said.

The actual expansion size remains under considerations and yet to be revealed, but Ferraro said: “The extra alumina that would be produced ‘would not fill’ the 7.8 million tonnes ‘gap’ that he sees between supply and demand over the next five years.

“There is a couple of million tonnes coming on stream in Indonesia and some in India but not to meet the 7.8 million tonnes in full that we forecast will be required,” he said.

“I can’t say to you that we are going to take it [the expansion studies] off the shelf tomorrow, but we certainly want to engage and have a conversation as to what the market is going to look like at the time we sit down and revisit it.”

Alumina Ltd holds a 40% stake in the refineries and the remaining 60% stake remains with Alcoa, so for any expansion, backing from the majority owners in the USA is very much required.

On 25th May 2021, Mike Ferraro and Chairman Peter Day informed shareholders in Melbourne that they had assigned Chief Financial Officer Grant Dempsey to find a way to disburse more of the company’s franking credit balance to shareholders.

Responses