AMAG Group demonstrated remarkable resilience in Q3 2024 despite the ongoing economic challenges in Europe, achieving 8 per cent year-over-year growth in EBITDA. The Metal Division maintained a strong earnings performance across the first three quarters, underscoring the Group's stability in a fluctuating market.

The Casting Division saw earnings fall short of last year, but overall quality remained strong despite persistent headwinds in the automotive industry. Meanwhile, the Rolling Division capitalised on market opportunities, demonstrating remarkable flexibility that helped mitigate volume and price pressures in the current reporting period.

Dr Helmut Kaufmann, CEO of AMAG Austria Metall AG, said, "With the economic situation in many European countries remaining subdued, we have so far succeeded in generating solid earnings through product mix shifts and a high degree of flexibility. Nevertheless, the weak industrial economy in Europe is leading to increasing pressure on prices and volumes in numerous industries.”

“We continue to meet these challenges with a clear focus on innovation and sustainability. Once again, we increased our research expenditure in the first three quarters of 2024 in order to keep our shares of specialities at a consistently high level."

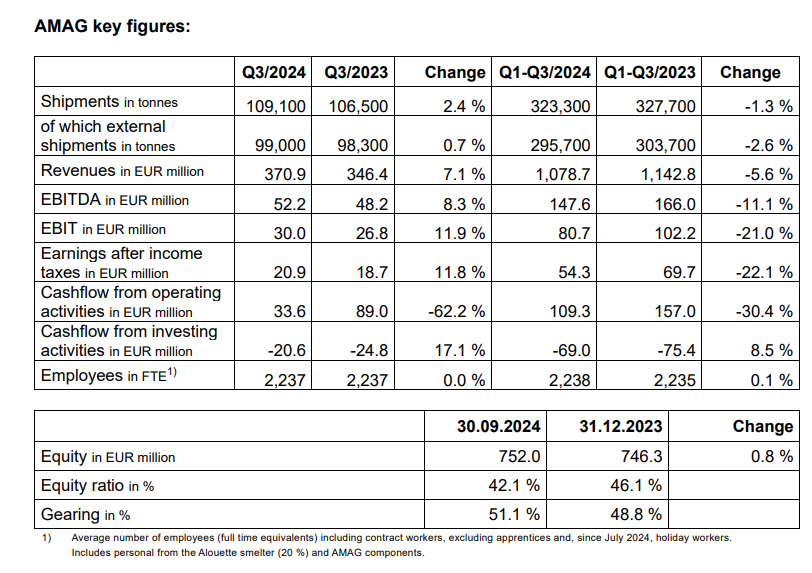

The AMAG Group's revenues totalled EUR 1,078.7 million in the first three quarters of 2024 (Q1-Q3/2023: EUR 1,142.8 million). Prices and volume effects are primarily responsible for the deviation. Although the AMAG Group's shipment volumes grew in the third quarter of 2024, there was a slight decrease overall in the first nine months of the year compared to the same period of the previous year at 323,300 tonnes (Q1- Q3/2023: 327,700 tonnes).

In the current reporting period, EBITDA reached EUR 147.6 million, down from EUR 166.0 million the previous year. The Metal Division maintained positive momentum, with stable production in Canada and favourable valuation effects related to inventory hedges playing a key role. The Casting Division achieved steady operating profits across all three quarters, though these were slightly lower than last year's, reflecting challenges in the European automotive sector. Meanwhile, the diverse structure of the Rolling Division allowed for flexible product mix adjustments, effectively softening the impact of decreased demand from several European industries.

Depreciation and amortisation increased to EUR 66.8 million in the first three quarters (Q1-Q3/2023: EUR 63.8 million). The operating profit (EBIT) totalled EUR 80.7 million in the current reporting period (Q1-Q3/2023: EUR 102.2 million). Net income after taxes amounted to EUR 54.3 million in the first nine months (Q1-Q3/2023: EUR 69.7 million).

A strong cash flow of EUR 109.3 million was generated from operating activities (Q1- Q3/2023: EUR 157.0 million). A total of EUR 69.0 million was spent on investments (Q1- Q3/2023: EUR 75.4 million). Accordingly, free cash flow in the current reporting period totalled a solid EUR 40.2 million (Q1- Q3/2023: EUR 81.6 million).

Net financial debt stood at EUR 384.5 million as of September 30, 2024, compared to EUR 364.3 million at the end of 2023. Equity grew from EUR 746.3 million at the end of 2023 to EUR 752.0 million as of the current quarterly reporting date. The equity ratio currently stands at 42.1 per cent (December 31, 2023: 46.1 per cent).

Earnings trend in the third quarter of 2024

The AMAG Group's shipment volumes grew year-on-year to 109,100 tonnes in the third quarter of 2024 (Q3/2023: 106,500 tonnes). The average aluminium price also developed positively, rising from 2,200 USD per tonne in Q3/2023 to 2,421 USD per tonne in Q3/2024. This was accompanied by an increase in revenues to EUR 370.9 million (Q3/2023: EUR 346.4 million).

At EUR 52.2 million, EBITDA exceeded the previous year's level of EUR 48.2 million. The increases in the Metal Division and Rolling Division are particularly responsible for the AMAG Group's earnings growth in the third quarter of 2024.

Considering depreciation and amortisation of EUR 22.2 million (Q3/2023: EUR 21.4 million), EBIT grew to EUR 30.0 million in the third quarter of 2024 (Q3/2023: EUR 26.8 million). Earnings after income taxes grew to EUR 20.9 million (Q3/2023: EUR 18.7 million). Cashflow from operating activities totalled EUR 33.6 million in Q3/2024 (Q3/2023: EUR 89.0 million).

Outlook 2024

The global economic environment continues to develop unevenly. While the USA is expected to see noticeable GDP growth of +2.5 per cent, the economy in the eurozone is expected to grow by just +0.8 per cent. The weak industrial sector, in particular, is depressing economic growth. The WIFO Institute anticipates stagnation in Germany, while the Austrian economy is expected to shrink by -0.6 per cent in 2024.*

The AMAG Group's broad positioning and firmly anchored strategy have enabled it to achieve solid revenue and earnings figures in this difficult environment. Nevertheless, the persistently weak European industrial economy is also making itself felt in several AMAG sales markets, leading to increased pressure on prices and volumes.

According to the economic forecasts cited, the economic situation is expected to not improve in the fourth quarter of 2024. This means that the environment will remain challenging, especially in the Casting and Rolling Divisions. In the Metal Division, the significant rise in alumina prices will have an impact on earnings in the coming months. In addition, the further development of aluminium prices and any valuation effects may also have a noticeable impact on earnings in Q4/2024.

Based on the assumptions made, AMAG’s Management Board can confirm the EBITDA range of EUR 160 million to EUR 180 million for the 2024 financial year communicated at the end of July 2024. The upper limit is primarily linked to valuation effects whose probability of occurrence can only be forecast to a limited extent.

*Austrian Institute of Economic Research (WIFO), Economic Forecast 3/2024, October 2024

Image credit: AMAG Group financial results publication (emailed by AMAG)

Information credit: AMAG Group financial results publication (emailed by AMAG)

Responses