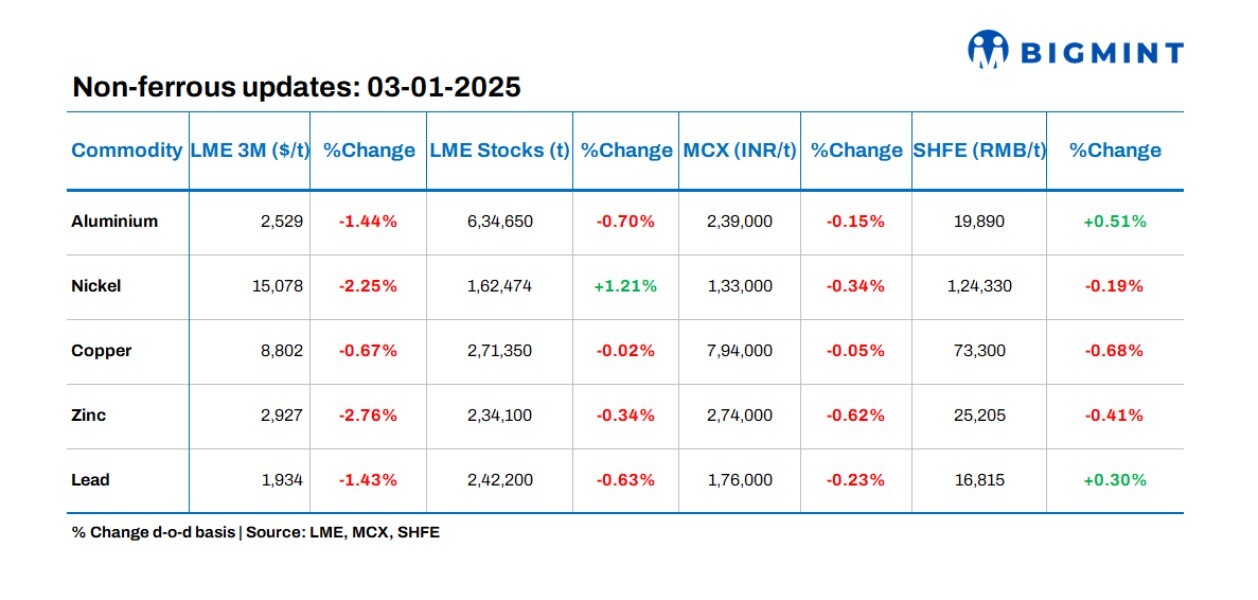

Base metals prices on the London Metal Exchange (LME) showed negative trends, with zinc recording the highest drop of 2.76 per cent d-o-d. Meanwhile, inventories at LME-registered warehouses witnessed outflows, except for nickel stocks, which increased by 1.21 per cent d-o-d.

COMEX market update

Copper prices on the COMEX market stood at $8,797/tonne (t), stable compared to the previous close.

Indian market overview

In India's non-ferrous metals markets, BigMint assessed domestic copper armature scrap at INR 743,000/t ex-Delhi. Aluminium Tense scrap prices remained stable d-o-d, with ex-Delhi at INR 174,000/t and ex-Chennai at INR 175,000/t.

Global updates

Global factory activity weakens as economic concerns rise

Factory activity in Europe, Asia, and the US ended 2024 on a weak note, with manufacturing slowing across key regions. Europe faced intensified declines, especially in Germany, France, and Italy. Asia saw a slowdown in China and South Korea, though Taiwan showed growth. US manufacturing contracted for a sixth straight month amid concerns over rising trade risks and potential tariffs under a second Trump presidency.

Canadian factory PMI reaches 22-month high in Dec

Canada's manufacturing activity saw its fastest growth in nearly two years, with the Purchasing Manager's Index (PMI) rising to 52.2 in December. The increase was driven by US clients building inventory in expectation of potential trade tariffs. However, supply chain disruptions and delays in deliveries continued to challenge the sector. A weaker Canadian dollar also helped boost export competitiveness.

Global alumina production grows 1.9 per cent y-o-y in Jan-Nov'24

World alumina production increased by 1.9 per cent y-o-y in January-November 2024 to 125.66 million tonnes (mnt) despite a curtailment in output at Alcoa's Kwinana refinery. However, November's production saw a 3.22% dip compared to October, with daily output averaging slightly less. Despite this, production in November grew 2.2 per cent y-o-y.

Oil prices edge up

Oil prices edged up at the start of 2025 as market sentiment turned positive. Optimism grew due to expectations of stronger economic recovery and increased oil demand, driven by China's growth measures and strong US oil consumption data. Brent crude futures were recorded at $76/barrel today. Meanwhile, WTI crude oil futures increased slightly by 0.11 per cent d-o-d to $73.21/barrel.

Natural gas prices down

Natural gas stood at $3.56/metric million British thermal unit (MMBtu), down by 2.73 per cent d-o-d.

Dollar index inches down

The dollar index, which measures the value of the greenback against a basket of six major currencies, hovered at 108.99, down by 0.22 per cent d-o-d at the time of reporting. The Indian rupee was recorded at INR 85.75 against the dollar.

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

Top image credit: BA Systems

Responses