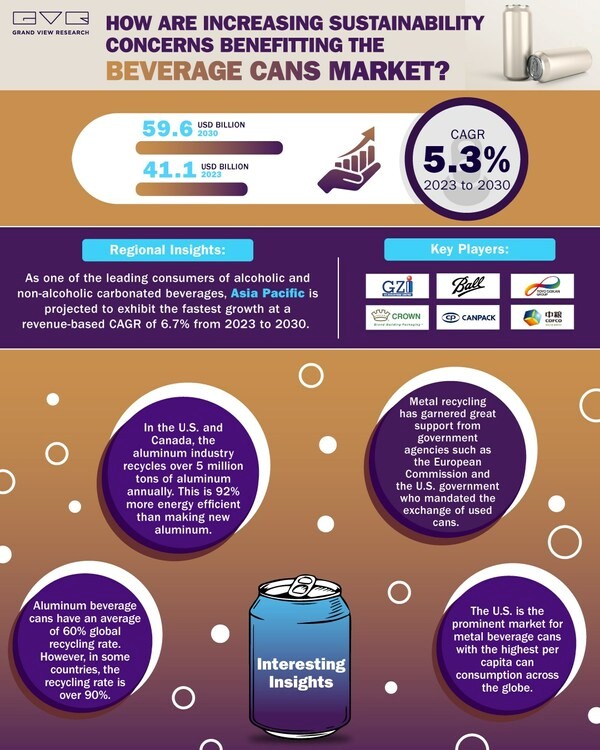

According to a recent analysis by Grand View Research, Inc., the size of the worldwide beverage cans market is anticipated to exceed USD 59.6 billion by 2030. From 2023 to 2030, the market is expected to grow at a CAGR of 5.3 per cent. Aluminium cans are becoming increasingly popular because of their superior qualities, namely their lightweight and the expanding aluminium recycling industry.

The primary factor driving market expansion is consumer desire for highly portable and excellent beverage packaging for protection from the outside environment. With a maximum volume share of 95.1 per cent in 2021, the aluminium category now dominates the market, and it is expected to continue to do so from 2023 through 2030. Due to the advantages of aluminium, the market is also anticipated to continue seeing its strongest revenue growth, with a CAGR of 5.4 per cent throughout the projection period.

In 2022, the aluminium category had the highest volume share (95.2 per cent). For the forecast period, the market expansion for aluminium cans is anticipated to be supported by the growing emphasis on recycling abandoned metal items. Aluminium recycling increased to 56 per cent in 2019, up from 41 per cent in 2010 and 52 per cent in 2018, according to the National Packaging Waste Database.

The appearance, durability, and shelf life of packaged beverages have been regularly improved by beverage can companies. Ball Corporation stated in July 2021 that it will construct new aluminium beverage packaging facilities in the United Kingdom. The firm also wants to develop new state-of-the-art facilities to support more revenue and increase its market share in the nation. Categories where sustainable cans have seen substantial growth, include wines, waters, hard seltzers, and ready-to-drink cocktails.

With significant revenue and volume share, the aluminium can sector dominates the global market. Aluminium can research and development is a constant priority for producers as they try to meet the growing demand for sustainability on the international market. For its aluminium beverage cans, The Coors Brewing Company, for instance, employs ultraviolet (UV) light curing technology.

The business provides a cheap substitute to the pricey heat treatments used in typical convection heat ovens for curing the inks by using coating materials that cure when exposed to UV light. Additionally, the UV-cured process uses less solvent than its alternatives, which results in reduced emissions and a smaller waste stream.

Responses