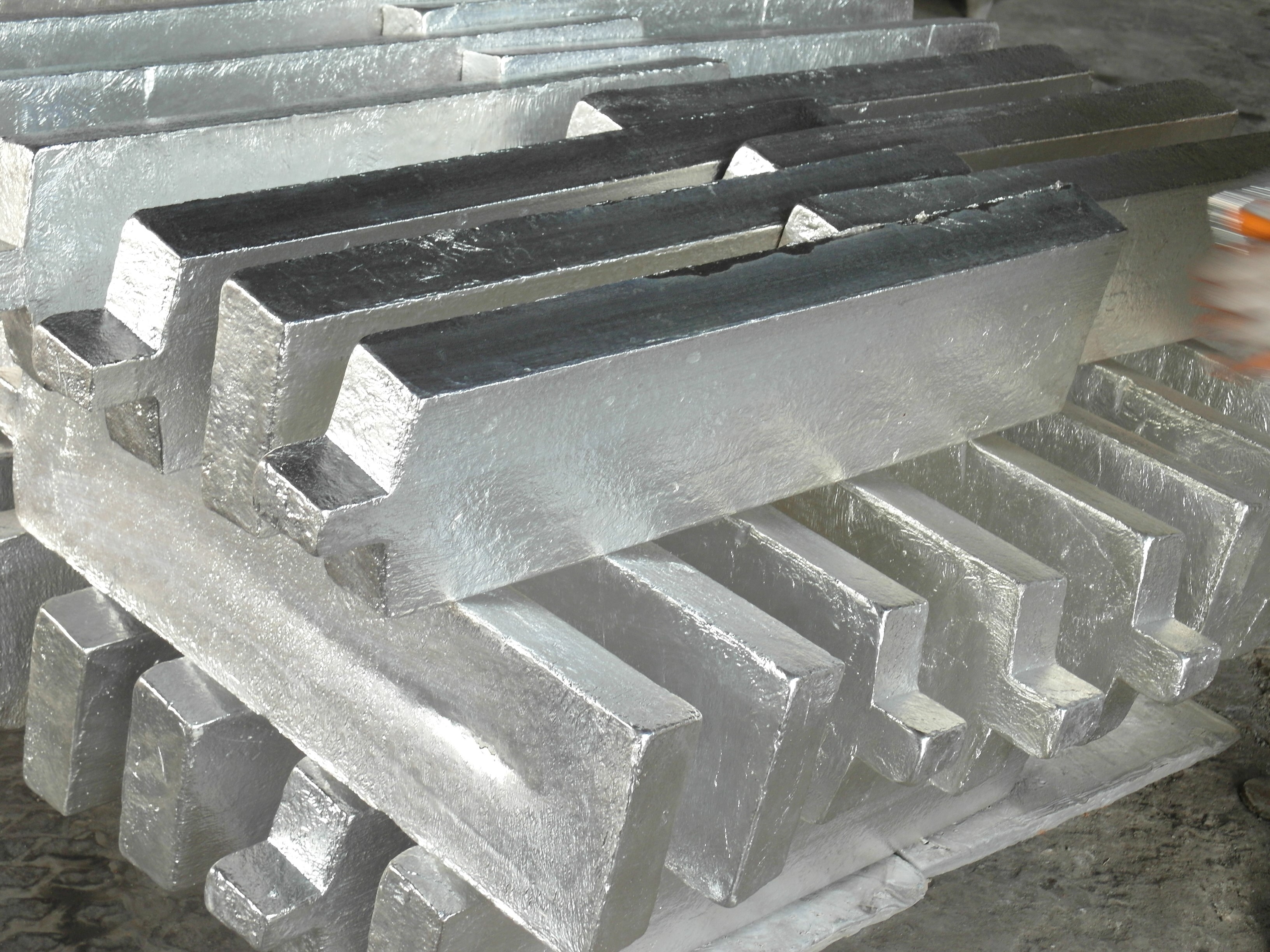

The global auto industry has been alerted for the shortfall of components driven by the Chinese energy crisis. The power distress is restricting the nation towards production curb across a wide range of industries, but especially the impact is huge on aluminium alloys supply.

China controls 87% of the World’s magnesium production with functionalizing 50 smelters, while the govt. has directed around 35 magnesium smelters to cease production until the end of 2021. The rest in operation will be producing only 50% of their capacity to ensure energy consumption targets are successfully achieved. Magnesium is a vital component in the production of aluminium alloy.

The dearth of the metal could sceptically jolt the global automotive industry.

Amos Fletcher, Director of Mining Equity Research, Barclays Investment Bank stated: “There are no substitutes for magnesium in aluminium sheet and billet production.”

“35% of downstream demand for magnesium is for auto sheet, so if magnesium supplies stop, the entire auto industry will potentially be forced to stop.”

Energy cost has always been a key driver of aluminium prices, as one tonne of aluminium takes 16-megawatt hours (MWh) of power, then by comparison one tonne of magnesium takes 35-40 MWh, creating power costs an even more crucial cost navigator for the metal.

The metal prices are sky-rocketing, which is a result of both express surges in Chinese export prices and the lack of backup inventory in Europe and other places.

The European Aluminium has urged the EU and national governments to work immediately with their Chinese counterparties. The panic emerges, as Beijing will now restrict the remaining production to its vast domestic aluminium industry, while the reserves in Europe are likely to dry out approximately by the end of November.

Responses