Aluminium Foil is the 286th most traded product and the 348th most complex product according to the Product Complexity Index (PCI). Revenue wise, the top exporters of Aluminium Foil are China ($2.97B), Germany ($1.46B), Italy ($611M), Japan ($587M) and the United States ($554M).

China’s semi-finished aluminium export including foil has been on the rise mostly driven by higher demand and lower prices. Especially for foil, commercial kitchen and packaging foil suppliers around the world rely on Chinese foil for convenience.

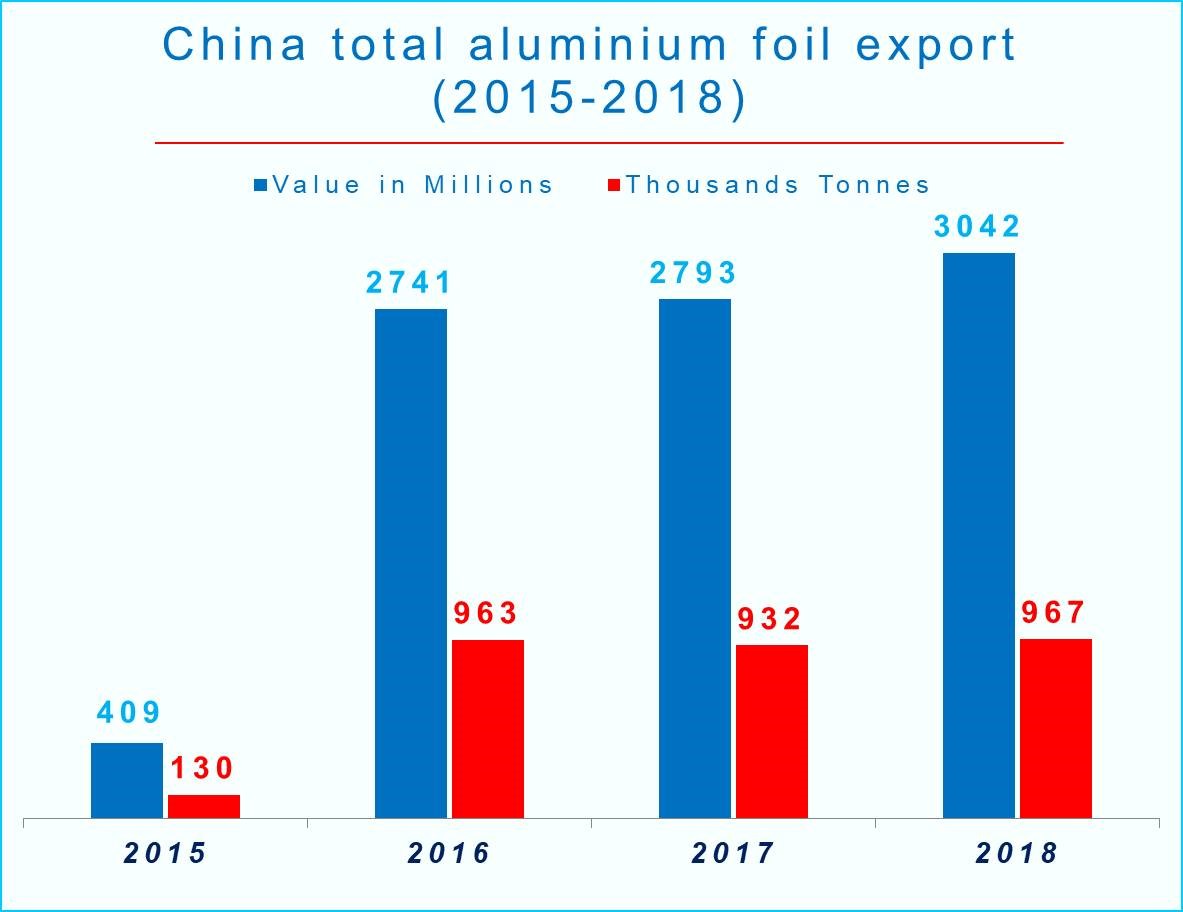

{alcircleadd}Data shows in 2015, China exported 130,222 tonnes of aluminium foil and earned export revenues of US$ 410 million. In 2016, the volume dramatically increased to 963,447 tonnes and revenue increased to 2.7 billion tonnes. The rise in foil export was driven by increased subsidized productions and export incentives and tax rebates. This was supported by highly competitive prices in the international market.

The west started getting concerned about the growing import and the U.S. started investigations on the import of Chinese aluminium foil. In March of 2017, the Aluminum Association’s Trade Enforcement Working Group filed anti-dumping and countervailing duty (AD/CVD) petitions against the import of aluminium foil products from China. In October 2017, Department of Commerce imposed preliminary duties in a range of 96% to 162% on Chinese aluminium foil import. After this, the total export dropped to 932,229 tonnes in 2017 and the export revenue stayed flat at US$2.7 billion.

China’s total aluminium foil export is estimated at 967,542 tonnes in 2018 and the revenue is expected to stand at US$ 3 billion dollar.

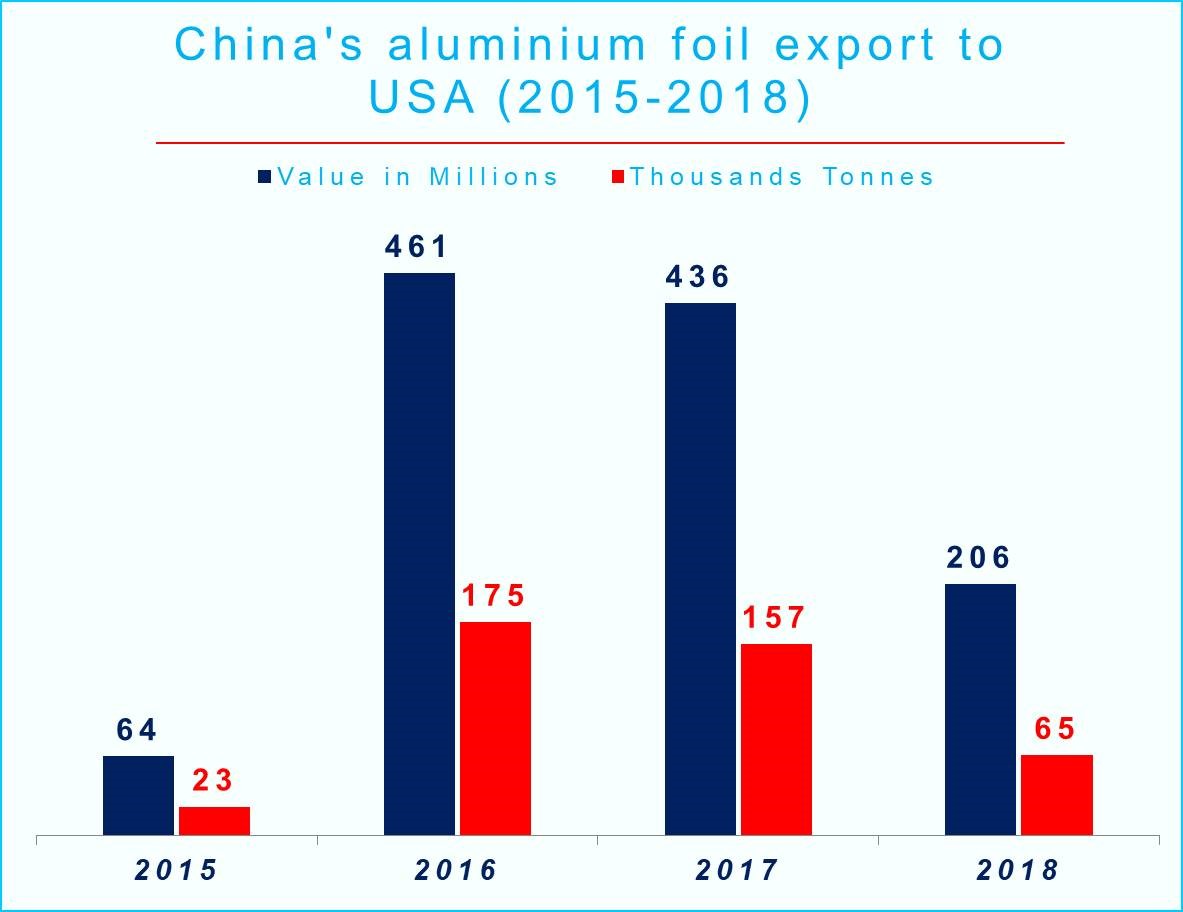

In March 2018, the U.S. International Trade Commission (ITC) announced that, Commerce Department would impose duties from 49 per cent to 106 per cent on Chinese aluminium foil. This had a strong impact on China’s export to the U.S. though the total export was not much affected. The below graph presents how aluminium foil exports to the U.S. from China drops in 2017 and 2018.

Twelve years ago, U.S. production accounted for about 84 per cent of all domestic aluminium foil demand and today that has dropped to 69 per cent. At the same time, Chinese imports grew from essentially 0 per cent of the total U.S. aluminium foil market in 2004 to 22 per cent of the market in 2016. Though the duties have restricted aluminium foil exports to the U.S. the total volume remained strong as the country shifted the exports to other destinations in Asia.

Responses