China’s giant aluminium production sector looks like being untouched by the COVID-19 crisis, according to an observation by a columnist for Reuters. The country’s annualised production has increased by 718,000 tonnes over the first five months of 2020, as per the latest estimate from the International Aluminium Institute (IAI), bringing its share to the world aluminium output to 57 per cent in May. But in contrast, the annualised aluminium production in the rest of the world has decreased by 612,000 tonnes over the same period (January-May), owing to restricted movements and low international prices, which have led many smelters to close or curtail their productions.

China is already the world’s largest aluminium producer and it dominance over the world is less likely to not increase in the near and/or long-term, particularly when the US Administration’s venting of its aluminium frustrations on Canada reduces the chances of multilateral action to stop it.

Chinese aluminium output fell last year for the first time in a decade, largely because of unplanned outages at a couple of biggest smelters. But analysts’ consensus would always hint a renewed growth spurt in 2020. Except in March, when China’s lockdowns were at peak due to the COVID-19 spread, annualised monthly production rates remained above 36 million at the beginning of the year.

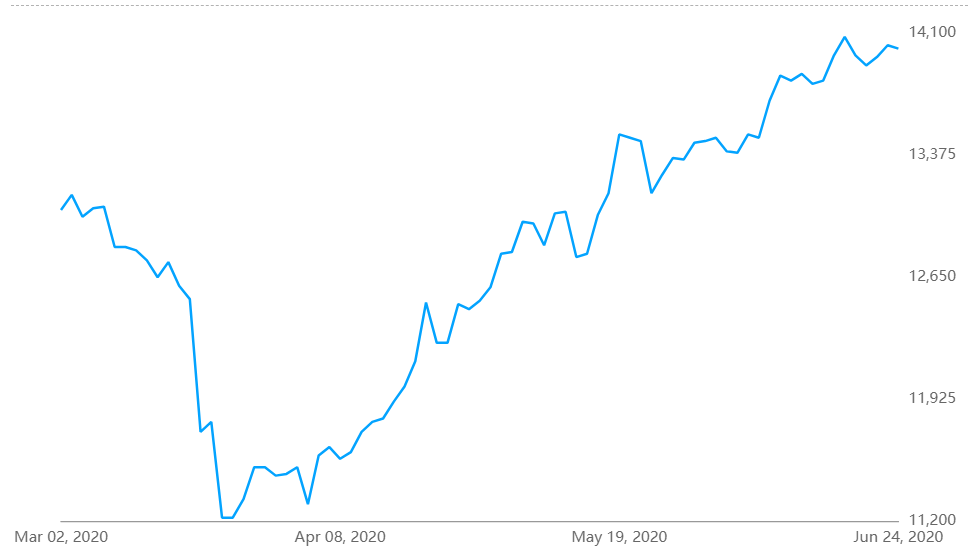

Shanghai aluminium prices also started rebounding from the March slump, easing some of the previous financial stress on the country's operators. New smelters began coming online, such as Yunnan Aluminium announced the commissioning of a 500,000 tonnes per year plant in Wenshan region of the province. Having said that, Wenshan is emerging a new Chinese production hub as the place is lucrative for smelting with cleaner hydro power availability.

Hence, it is clear by almost halfway through 2020 that Chinese aluminium production is rebounding.

Even many Western smelters having counterparts in China are not directly affected by the COVID-19. The only exception is Aluar, which temporarily closed half of its 460,000 tonnes per year capacity during the country’s lockdown.

But more than this, the heavier toll has been on international aluminium demand and price. As the London Metal Exchange inventories are sharply rising, the price has come down to as low as US$ 1564 per tonne as of June 25 and still struggling to stage any significant recovery from the last month’s four year low of US$ 1438.5 per tonne .

This downward price trend has already started weighing on smelters’ margins, resulting in closures. For instance, Alcoa has announced to permanently close its Ferndale smelter in the U.S. state of Washington, which was already operating at a reduced capacity of 230,000 tonnes.

Rio Tinto’s two smelters, one in Iceland and one in New Zealand, are under strategic review.

But even though China’s aluminium production has increased, its semi-finished exports have recorded a plunge owing to the sluggish demand in the end-use sector across the globe. Semis shipments have slowed this year to the tune of 10% as overseas demand collapsed.

But with some of the rising national frictions such as the recent declaration of 10 per cent tariffs by the US on Canada due to an alleged surge of metal entering from the latter to the U.S. market, there will no check on China and it will continuing doing what it does the best – aluminium production it is.

Responses