China’s Baoshan Iron and Steel (Baosteel) and Baowu Aluminum have partnered with Japan’s Kobe Steel to form a new joint venture in a significant move within the automotive materials sector. This collaboration aims to produce aluminium sheets specifically for the automotive industry.

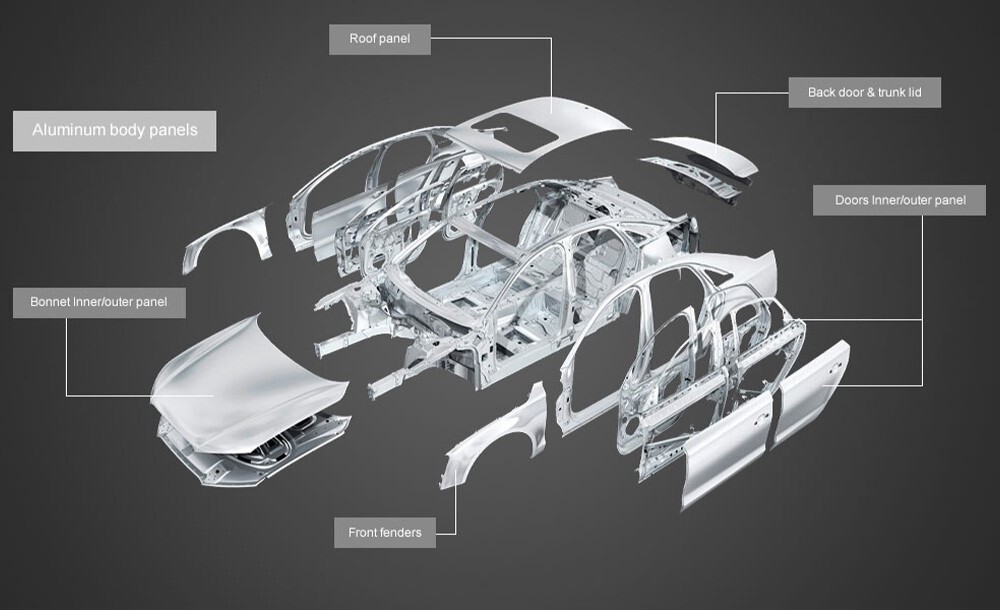

The automotive industry's demand for aluminium is expected to surge by 15-27 per cent, driven by the growing prevalence of electric vehicles (EVs). In comparison to traditional internal combustion engine cars, plug-in hybrid and full battery electric vehicles utilise 25-27 per cent more aluminium, with a baseline of 160kg per vehicle in internal combustion engines.

Under the agreement, Kobe Steel will hold a 50 per cent stake in the new entity, while Baosteel and Baowu Aluminum will jointly own the remaining 50 per cent. The precise ownership split between Baosteel and Baowu Aluminum has not been disclosed.

However, pending regulatory approvals, the venture is set to be established in Shanghai with a registered capital of RMB 900 million ($125 million). It will operate under the provisional name Kobelco Baosteel Automotive Aluminum Rolled Products.

The joint venture will focus on manufacturing aluminium sheets for domestic automobile manufacturers in China, with production facilities planned in Tianjin and central Henan province. This strategic partnership reflects a growing trend of international collaboration to meet the rising demand for automotive materials, especially in the rapidly expanding Chinese market.

The companies had previously announced a feasibility study for this joint venture on February 26, paving the way for this formal agreement.

The joint venture will focus on manufacturing aluminium sheets for domestic automobile manufacturers in China, with production facilities planned in Tianjin and central Henan province. This strategic partnership reflects a growing trend of international collaboration to meet the rising demand for automotive materials, especially in the rapidly expanding Chinese market.

The companies had previously announced a feasibility study for this joint venture on February 26, paving the way for this formal agreement.

Despite the overall economic slowdown, transportation (electric vehicles and aerospace) is expected to see continued demand growth for aluminium, driving downstream activity. Transportation will be a key demand driver for aluminium, where EVs will play a pivotal role.

Global aluminium usage in transportation by end-use, 2023 (%)

Total usage: 27.5 million tonnes (estimated)

Aluminium usage in the transportation sector stood at 27.5 million tonnes in 2023. The demand is likely to reach 28.2 million tonnes in 2024. Passenger cars are the single largest user segment of aluminium amongst other transport sectors, and the rise of EVs is also crucial.

China’s new energy vehicles (NEV) sector, which encompasses battery electric vehicles and plug-in hybrids, is experiencing rapid growth. According to China Customs data, NEV production in the first eight months of 2023 surged by over 37 per cent, reaching a total of 5.44 million units.

While the rise in aluminium usage in traditional cars is mainly attributed to the weight reduction benefits, the surge in aluminium demand for EVs is equally influenced by innovative applications beyond the use of aluminium body sheets. This shift highlights a broader transformation in the automotive industry as it adapts to the unique requirements of electric vehicle technology.

Responses