China’s primary aluminium inventory plummets 85,000 tonnes W-o-W on March 24

According to the Shanghai Metals Market, China's primary aluminium inventories have witnessed a considerable slump of 85,000 tonnes on a weekly basis across eight major consumption areas, including SHFE warrants. On Thursday, March 23, the inventories came in at 1,126,000 tonnes, which in comparison with the third Monday of this month, March 20, plummeted by 38,000 tonnes. The social aluminium inventories built up 85,000 tonnes Y-o-Y but have continuously fallen 143,000 tonnes from the highest recorded number in March.

Lesser cargo arrivals in South China have directly resulted in major market drops. Though East China reported smooth warehouse outflows, stringent downstream demands primarily disrupted the trade sector in Gongyi and Henan.

Last week, on March 16, the primary aluminium inventories stood at 1,211,000 tonnes, which plunged across eight major consumption areas to come in at 1,126,000 tonnes on March 23, Thursday, with a W-o-W fall.

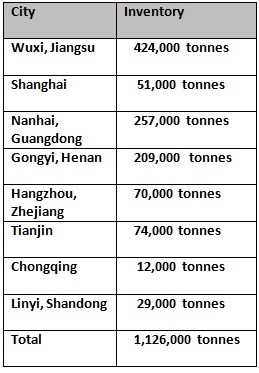

The chart below indicates the current status of primary aluminium inventories across China in more detail:

The eight provinces in China all have experienced depreciating conditions this week, with aluminium inventory marking the highest fall in Nanhai by 27,000 tonnes to 257,000 tonnes, followed by a decline of 26,000 tonnes in Wuxi to officially close at 424,000 tonnes. In Gongyi, the aluminium inventory has decreased by 18,000 tonnes to 209,000 tonnes. Shanghai recorded a drop of 6,000 tonnes, accumulating 51,000 tonnes. In Hangzhou and Chongqing, the aluminium inventories shed 3,000 tonnes, closing at 70,000 tonnes and 12,000 tonnes, respectively.

Lastly, in Tianjin, the aluminium inventory descended by 2,000 tonnes to 74,000 tonnes. Only Linyi displayed no signs of change.

This news is also available on our App 'AlCircle News' Android | iOS