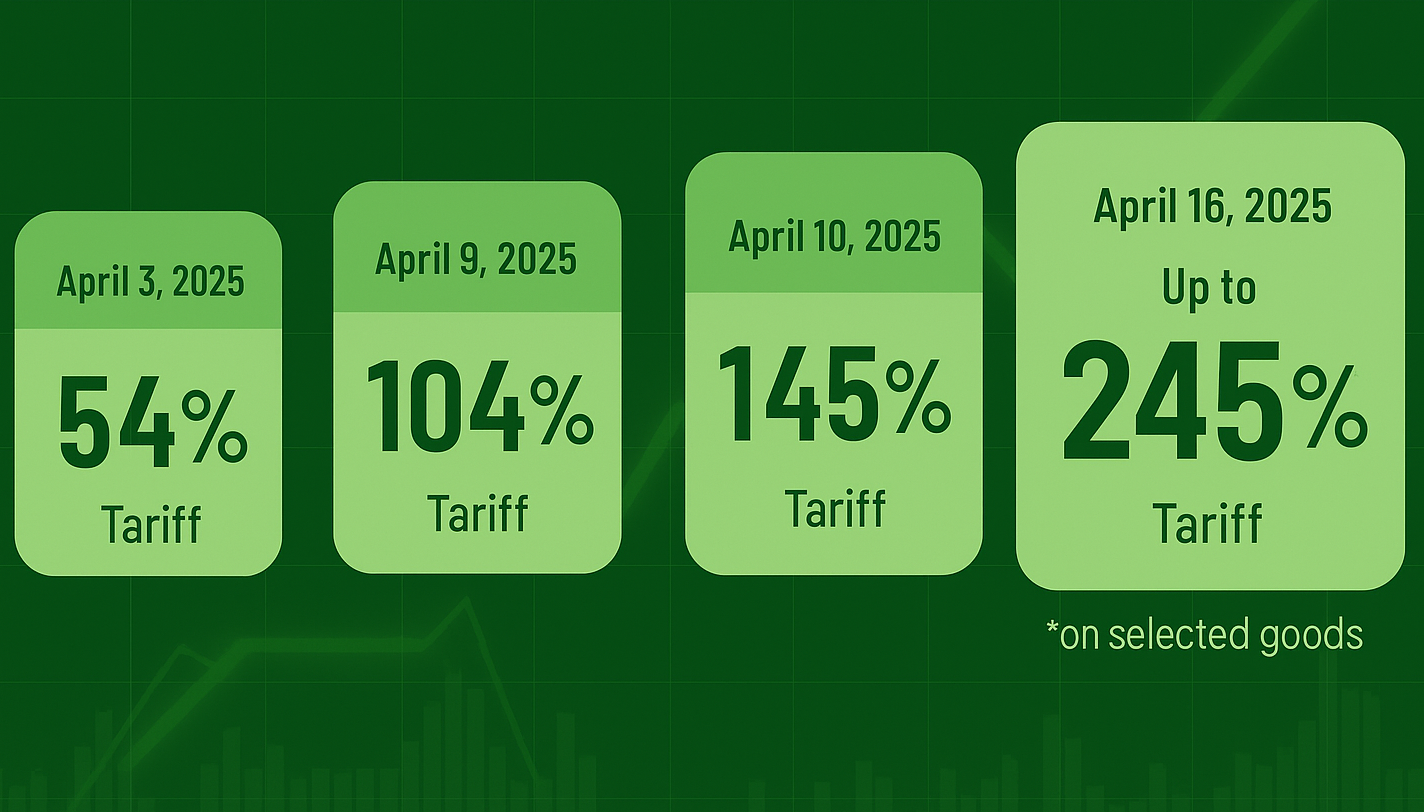

In the recently held trade event, Canton Fair, in China, the nation’s businesses approached their Indian counterparts to help escape the tariff whip. In the past three months, China started off with witnessing a 10 per cent tariff and then the curve shot upwards to recently being whiplashed with a whopping 245 per cent tariff. And the ripple effect has started to hit other Asian countries as well.

Image Source: https://www.angelone.in/

Image Source: https://www.angelone.in/

As revealed by Ajay Sahai, Director General of the Federation of Indian Export Organizations, at the Guangzhou-held Canton Fair, which is still on the event chart and is to conclude on May 5, several Indian firms were approached by Chinese companies to supply goods to their US customers. The arrangement here would be to supply the commodities under the brands of the Chinese firms or co-brand them with the Indian firms.

Earlier, it has been made evidently clear by the Indian government that the leaders do not plan to relax restrictions upon Chinese company-directed investments as the country’s leading authorities are keeping their guards up about capital flows from across the border, especially as US President Donald Trump’s tariffs have heightened concerns over Chinese firms and the redirection of their exports to India and other Asian markets.

“If we want to substitute China, we need to start producing things like it, for which we need investments, and the present situation does not provide enough confidence for it. Even if India were to benefit from this in the short term, that can only be done if we have China’s economies of scale,” on a related topic, cautioned Jayant Dasgupta, former ambassador to the World Trade Organisation (WTO).

But what if China’s approach to India’s manufacturers turns into reality? “Currently, China’s exports to the US are around USD 448 billion, whereas that for India is around USD 87 billion. We are at one-fifth of what China has been exporting to the US. Does an Indian manufacturer really have the spare capacity to start producing and exporting to the US immediately? The answer is probably no; building up capabilities itself will take some time to get into that sizable portion of China’s exports to the US,” said Hardik Shah, Director of CareEdge Ratings.

Another question that lingers is whether Chinese businesses are the only ones taking the brunt of all this. The answer is a big, fat ‘NO’. A lion’s share of the small businesses in the US that heavily rely on Chinese imports have a chance of closing down singularly owing to the raging trade war between China and the United States. What started as a minor cost bump, has now become the risk of 2X cost inflation.

Most of the queries coming from the fair's Chinese business associates were for sectors like hand tools, electronics, and home appliances. Sahai also shared that there is hope that some of the US customers may directly start negotiating with Indian suppliers. The commission paid to Chinese firms will be negotiated between buyers and suppliers.

From India’s perspective, the potential relocation of manufacturers from China is not solely driven by tariffs; it has been a long-standing issue due to various trade challenges China faces, according to Mukul Goyal, co-founder of Stratefix Consulting. To accelerate this trend, it is essential for India to implement measures that incentivize businesses. However, there are concerns that the government may consider phasing out the Production-Linked Incentive (PLI) scheme, which could hinder progress in this area.

Responses