Disrupted global trade routes fuel India’s aluminium alloyed ingots import by 60% in H1 2024

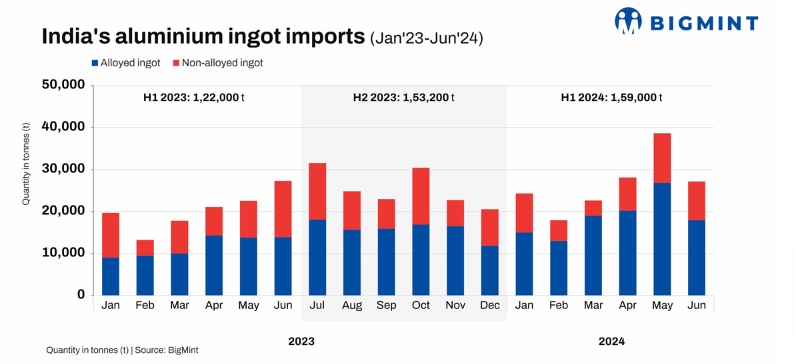

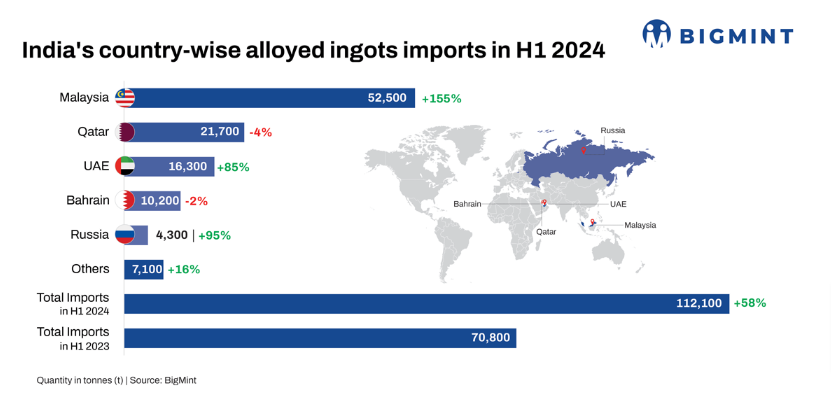

India's imports of alloyed aluminium ingots soared by 60 per cent in the first half of 2024, reaching approximately 112,158 tonnes compared to 70,780 tonnes during the same period in 2023. In the first half of 2024, alloyed ingots constituted a significant portion of the country's aluminium semi-finished imports, accounting for 62 per cent of the total 196,482 tonnes.

Reasons for the surge

The Red Sea crisis, which began in October 2023 and escalated over time, led to a shipping crisis that severely disrupted global trade and supply chains. This situation particularly affected routes through the Suez Canal, a vital passageway that handles roughly 30 per cent of the global container trade. Consequently, trade volumes decreased significantly in early 2024.

Ships were forced to reroute around Africa's Cape of Good Hope, increasing shipping and insurance costs. The delayed delivery of goods disrupted global supply chains, resulting in squeezed profit margins.

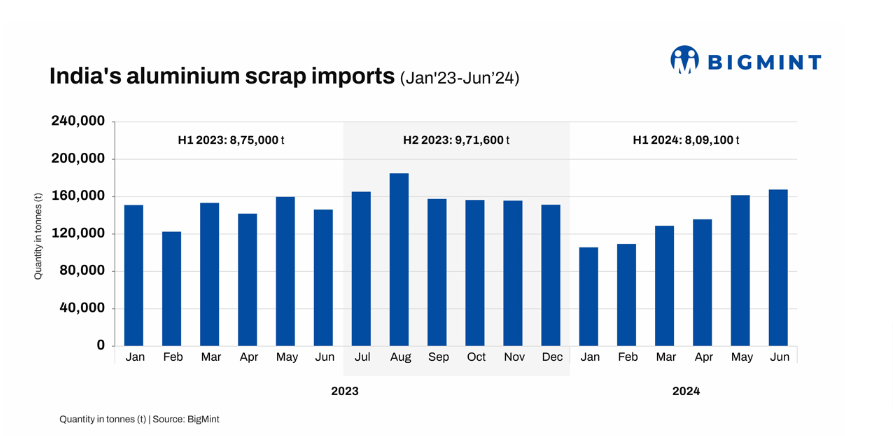

This disruption also negatively impacted aluminium scrap imports into India, especially from the Middle East and the UK, which supply 40-45 per cent of India's total scrap volumes. The decline in aluminium scrap imports led to increased demand for semi-finished products like alloy ingots. Imports of aluminium scrap, the key raw material for manufacturing alloy ingots, experienced a notable 8 per cent drop in the first half of the year, falling to around 809,100 tonnes from 875,000 tonnes in the first half of 2023.

Image source - BigMint

Rising scrap prices amidst shortage

Ongoing delays in aluminium scrap shipments prompted alloy manufacturers to source scrap domestically, resulting in depleted inventories. This shortage drove up domestic and imported scrap prices, leading to increased alloy imports. Consequently, demand for aluminium alloys remained strong, bolstered by robust order books from the automotive and aviation sectors. As a result, prices for certain scrap grades used in aluminium alloy production surged.

Russian sanctions affecting LME aluminium

In April 2024, LME aluminium prices increased significantly and continued into May, reaching a peak of $2,610 per tonne. This increase was driven by Western sanctions on Russian metals, which were aimed at cutting off a key revenue source for Russia's military activities in Ukraine.

The geopolitical uncertainty affected global supply and demand dynamics, increasing pressure on imported scrap prices, which soared above $2,000 per tonne for all grades. As a result, aluminium alloy manufacturers opted to import alloy ingots directly rather than purchasing costly scrap from overseas for domestic processing.

Image source - BigMint

Key imported grades rise 4-7%

According to BigMint's analysis, in the first half of 2024 (H1CY'24), average prices for key aluminium scrap grades showed notable increases. UAE tense (8-9 per cent), CFR Mundra, averaged $1,820 per tonne, marking a 4 per cent year-over-year rise. UK zorba averaged $2,064 per tonne, reflecting a 7 per cent increase compared to the same period in 2023.

Other grades, such as UAE taint tabor and extrusion, experienced an approximate 4 per cent year-over-year price increase in H1CY'24. In the first half of 2024 (H1CY'24), Delhi tense scrap prices increased by 9 per cent to INR 177,280 per tonne, up from INR 162,130 per tonne in the same period of 2023, according to BigMint's assessment.

Image source - BigMint

Image source - BigMint

Outlook

The short-term outlook is mixed. Prices for imported alloy ingots, which serve as substitutes for domestic ADC12 material, may decline due to a downward correction in domestic prices. However, imports of wheel-grade (A356) ingots, which have limited domestic production, may continue.

sourced from SteelMint under the content exchange agreement

This news is also available on our App 'AlCircle News' Android | iOS