There has been a significant challenge facing EU initiatives to tax carbon-intensive imports starting in 2026, as only a minority of companies have met the early reporting deadline for their carbon-intensive imports. The EU's carbon border adjustment mechanism (CBAM) represents a pioneering effort to impose a tax on carbon-intensive imports, aiming to prevent an influx of inexpensive goods from nations with highly polluting industries, which could undercut the bloc's heavily regulated sectors.

However, recent data from Germany's emissions trading authority, shared with the one of the world's leading business news organisations, Financial Times, indicates that less than 10 per cent of the anticipated 20,000 companies in Germany complied with the reporting requirements by the early deadline. Similar trends were observed in other member states, suggesting widespread difficulties in compliance.

According to the Swedish Environmental Protection Agency, 11 per cent of expected reports had been filed.

Jürgen Landgrebe from Germany's federal environment agency, UBA, said, "We expect a much larger number of reports than so far received."

"The most important reason is that most importers don't know about the obligation so far," he said, explaining that this was expected since the process was still in a "transitional period".

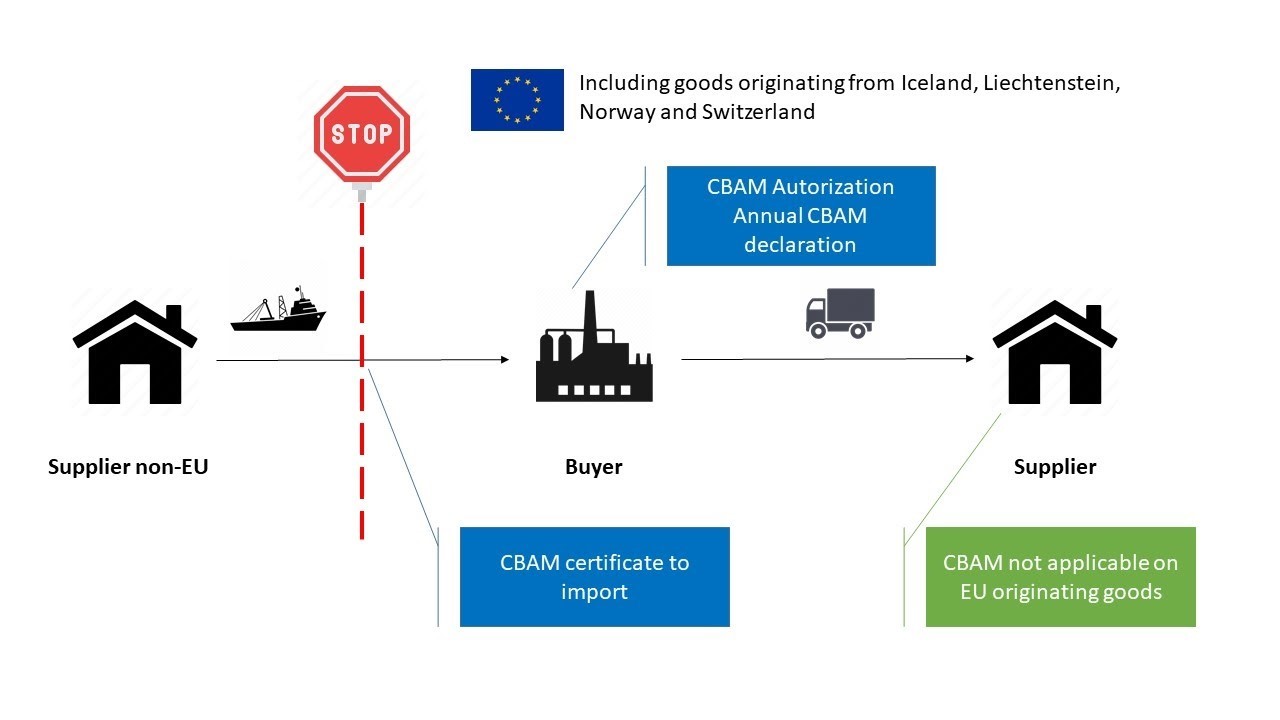

Until January 31, companies across seven sectors such as aluminium, steel, iron, and fertilisers were mandated to furnish reports detailing the emissions associated with their imports. This marks the initial trial period phase set to extend until 2026. Failure to comply with reporting requirements starting mid-July will result in fines of €50 per tonne of carbon emissions. Industry stakeholders are apprehensive about the increased bureaucratic procedures, adding to an already substantial administrative load and raising worries about the European Union's diminishing competitiveness.

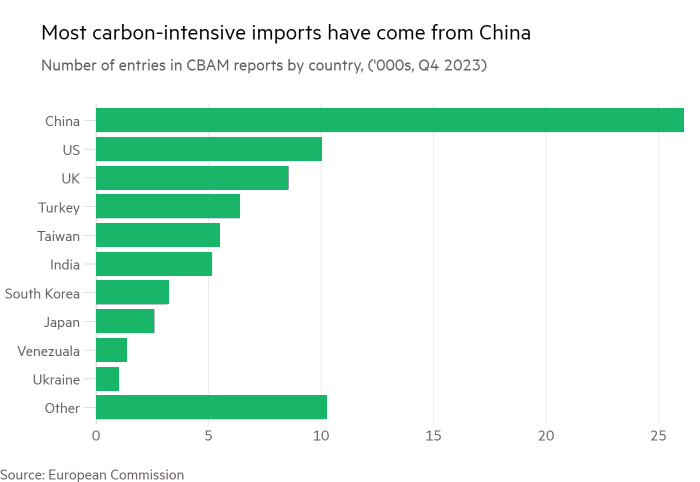

Sarah Hay, the Climate Policy Manager at the Norwegian aluminium producer Hydro, said, “There’s a lot of confusion and uncertainty.” Citi analysts warned EU countries that “with a larger share of imports from Russia, Turkey, India and China in particular could see input costs of cement and lime, fertilisers, iron and steel, and aluminium rise.”

Following a one-month extension to the deadline due to technical difficulties, the European Commission announced that nearly 13,000 reports had been submitted by the conclusion of February. Most of these reports pertained to imports from China, a nation that strongly disapproved of the measure.

In its initial evaluation of the levy in 2021, the commission anticipated approximately 239,000 import transactions to be subject to the measure annually. A senior EU official remarked that assessing the appropriate number of quarterly reports was challenging as estimations were conducted yearly.

EU officials downplayed its significance despite the apparent under-reporting, citing the measure's novelty. They indicated that proposals would soon be introduced to streamline the system based on early feedback from companies.

However, one official stated, “We need to ask the right questions so our figures become more accurate.”

Responses