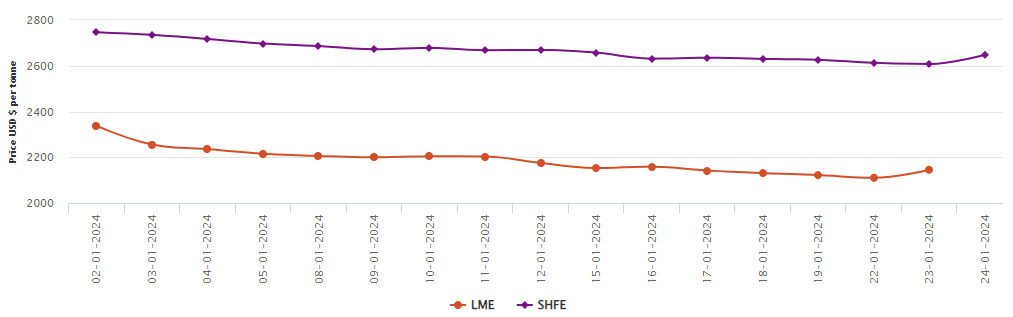

LME aluminium opened at US$2,159 per tonne yesterday, with its high and low at US$2,237 per tonne and US$2,156 per tonne, respectively, before closing at US$2,232 per tonne, up by US$77 per tonne or 3.57 per cent.

On Tuesday, January 23, both LME aluminium cash bid price and LME aluminium official settlement price expanded by US$35 per tonne or 1.65 per cent to settle at RMB 2,144.50 per tonne and US$2,145 per tonne. Aluminium prices edged higher following indications that the European Union is contemplating sanctions on Russian aluminium in anticipation of the second anniversary of the geopolitical crisis.

On the same day, both 3-month bid price and 3-month offer price gained US$32 per tonne or 1.48 per cent and US$31.5 per tonne or 1.46 per cent to arrive at US$2,185 per tonne and US$2,185.50 per tonne. As per the London Metal Exchange (LME) price graph, December 25 bid price and December 25 offer price ascended by US$30 per tonne or 1.24 per cent to peg at US$2,433 per tonne and US$2,438 per tonne.

LME aluminium opening stock came in at 548325 tonnes. Live warrants and Cancelled warrants arrived at 338875 tonnes and 209450 tonnes. LME aluminium 3-month Asian Reference Price inched down by US$0.08 per cent to clock at US$2,171.04 per tonne.

SHFE aluminium price

The SHFE aluminium price has increased by US$40 per tonne or 1.53 per cent to reach RMB 2,648 per tonne. Overnight, the most-traded SHFE 2403 aluminium contract opened at RMB 18,700 per tonne, with its lowest and highest at RMB 18,700 per tonne and RMB 18,945 per tonne before closing at RMB 18,910 per tonne, up RMB 265 per tonne or 1.42 per cent.

Responses