您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

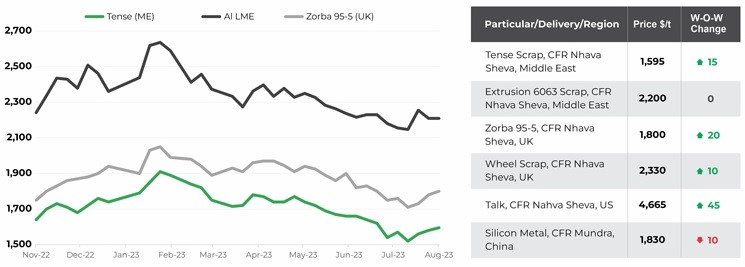

The Indian market for imported aluminium scrap saw varying trends this week. According to SteelMint's assessment, scrap prices diverged by approximately US$40-45 per tonne w-o-w. Adequate offers aligned with strengthening futures and buying inquiries resulted in moderate transactions in specific regions.

However, there was also a mixed buying pattern observed among particular end-users and traders who are cautious about near-term price levels and are observing future exchange price trends.

{alcircleadd}

Sourced from SteelMint and LME

Buyers based in the northern region were wary of highly volatile metal futures contracts while making bids and kept the bids lower by around US$20-40 per tonne. In contrast, importers based in the western region showed a willingness to engage in prospective deals and displayed a more optimistic outlook, according to a source.

Some end-users and traders anticipate prospective price hikes for aluminium P1020 ingot by one of the leading primary producers in the domestic market, which may bring positive sentiments in the near term.

Meanwhile, US-origin aluminium talk prices rose by US$45 per tonne w-o-w to US$4,665 per tonne CIF Nhava Sheva today. The remaining grades of scrap saw a rise of US$10-45 per tonne w-o-w. However, UK-origin taint tabor prices witnessed a decline of US$40 per tonne, and Middle East-origin taint tabor dropped by US$35 per tonne w-o-w.

The global aluminium market has experienced some levels of volatility, with a bid-offer disparity of around US$50-60 per tonne.

Aluminium scrap prices were higher compared to the previous trading day, with tense prices standing at INR 158,000 per tonne and utensil prices at INR 173,000 per tonne, both exy-Delhi and excluding GST.

Furthermore, scrap availability in the domestic market seems to be tight, specifically for tense, which is getting a premium of INR 2,000-3,000 per tonne in the northern region and supporting other grades, according to a trader.

China's silicon price stood at US$1,830 per tonne CIF Mundra, decreasing US$10 per tonne w-o-w.

Recently, around 40 tonnes (t) of aluminium tense from the UK were sold to West Coast India at US$1,735 per tonne, and about 400 t of aluminium zorba 94/4 from the UK were sold to West Coast India at US$1,810 per tonne.

Overall, the market for imported aluminium scrap has experienced mixed sentiments this week. However, it is expected to remain relatively stable in the next few days due to active deals and improved buying inquiries.

Responses