您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

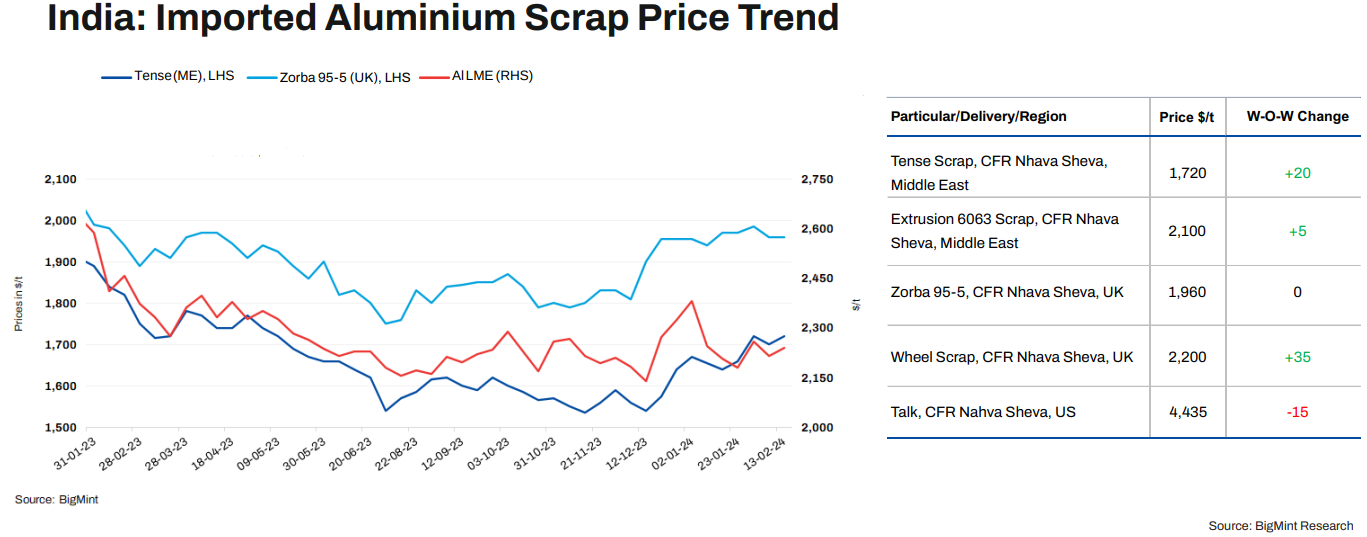

India is witnessing a surge in imported aluminium prices this week driven by several factors, including a notable increase in futures, limited availability of material, and a positive shift in demand. Across various grades of aluminium scrap, prices have risen by approximately $25-35/t w-o-w.

According to BigMint's assessment, Tense scrap of Middle East (UAE) origin has experienced a $20/t increase, reaching $1,720/t. Simultaneously, scrap prices from the US have seen a $30 per tonne (t) hike, now standing at $1,790/t w-o-w.

Notably, the sellers have reported that Zorba 95-5 of UK origin is currently facing challenges in the Indian market due to the Red Sea incident. As a result, Tense Scrap is gaining preference among buyers.

Furthermore, an indentor shared with BigMint that the prices for Zorba 95-5 grade are mismatched, with only a few buyers bidding close to $2,000/t till last week in Chennai, whereas this week, if we normalize the bid prices, it is in the range from $1,920-1,930/t. However, BigMint's assessment stands at $1,960/t due to lower bids.

Buyers have stated that India is experiencing material shortages, particularly in Tense scrap, which has led to a continuous increase in prices for both domestic and imported materials. In Chennai, buyers bid around $1,900/t CIF with a 2% attachment of Australian origin.

The bid-offer dynamics for certain scrap grades exhibit inconsistencies, introducing an element of uncertainty into the market. The three-month futures for aluminium are at $2,240/t, up by $25/t w-o-w, in line with LME registered warehouse inventories, which stand at 525,250 tonnes.

Talk scrap from the Middle East (UAE), and the US has seen a decrease of up to $50/t, driven by the recent decline in copper's three-month LME cash prices. Current copper LME prices hover at $8,290/t, down $90-100/t w-o-w.

Moving on to China-origin silicon 553 prices, the market is almost closed during the Chinese Lunar New Year holidays, with only a few participants actively trading. As a result, there were no firm prices in the market.

Silicon 553 is priced at approximately $2,030/t CIF Mundra, down $40/t.

Meanwhile, sellers from the Middle East (UAE) offering Zinc diecast with 4-5 per cent attachment are quoting prices ranging from $1,920-1,930/t CIF. However, the bids are below the $1,900/t level, resulting in BigMint's assessment prices being set at $1,905/t CIF West Coast.

In the domestic market, the scarcity of raw materials, particularly Tense scrap, has contributed to higher prices. Tense scrap prices are INR 170,000/t, while utensil scrap prices are INR 168,000/t ex-Delhi (excluding GST).

Looking ahead, considering the current market situation, it is expected that scrap prices may increase due to shortages in the country.

Received under the content exchange agreement with SteelMint

Responses