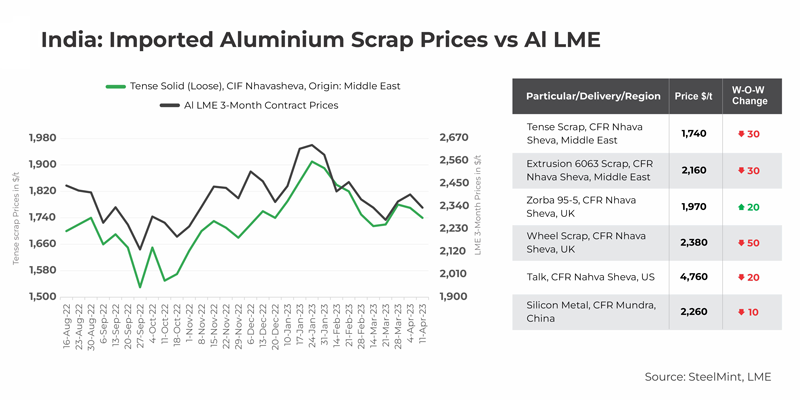

The price of imported aluminium scrap in India fell marginally, influenced by price movements on global commodities exchanges such as the London Metal Exchange (LME) and the Multi Commodity Exchange of India (MCX). These are recognised to have an impact on both the domestic and international markets in India.

As a result of the major commodity exchanges being closed for Good Friday and Easter, and then it was a weekend, relatively few transactions had been reported in the international market during the past few days.

Furthermore, trading channels observed a modest bid-offer imbalance in the market. Buyers have considerably lowered their bids for aluminium scrap by $40-60/t, resulting in weaker demand for the material in India's aluminium market.

Additionally, it was reported that scrap availability remained constrained in the major international markets or export destinations like the US and the UK. Middle East-based sellers are procuring at steeper prices but being able to sell at lower prices, leading to bid-offer disparities, loss of margins, and ultimately lifting less material too.

According to one of the major end-users, the domestic market also saw limited scrap supply during the Ramadan festival due to tight work schedules that hindered the management of the majority of the metal scrap build-up.

A trader stated, “Notably, exporters are holding back from making further offers as they are expecting a change in market dynamics in the near term.”

Outlook

Despite the current situation, major market participants do not anticipate a significant price decline in the near future due to the scarcity of scrap. However, some market participants or small- to medium-sized ingot manufacturers anticipate slight negative adjustments.

Received under the content exchange agreement with SteelMint

Responses