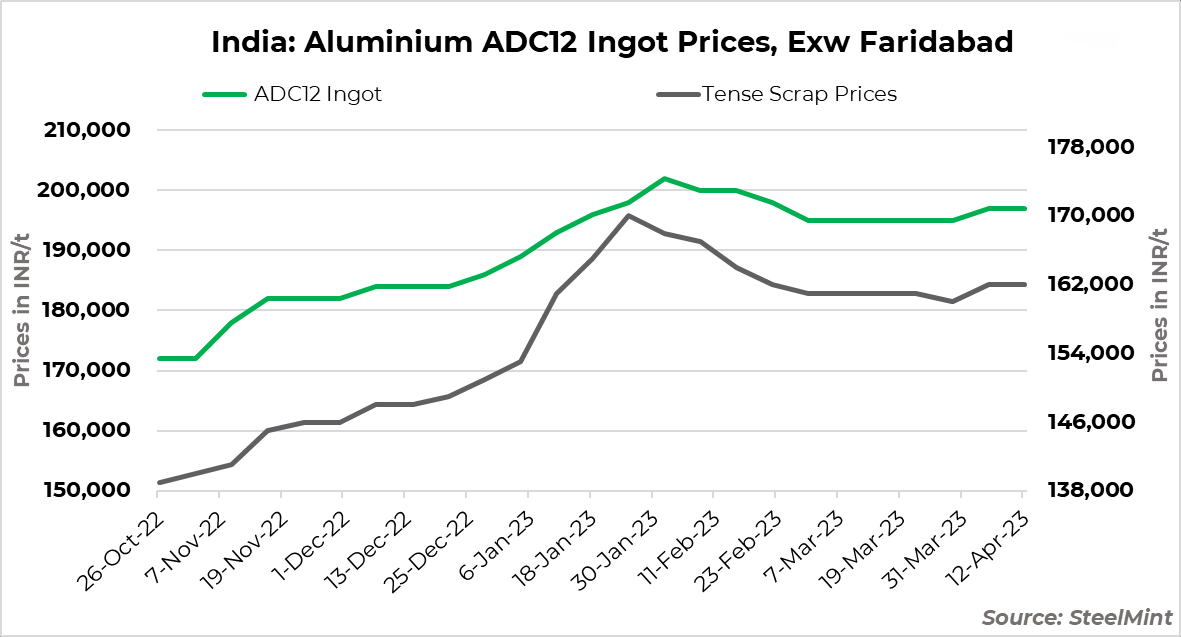

The domestic prices of aluminium alloy ingot ADC12 in India remained stable w-o-w at INR 197,000/t. Despite the start of the new fiscal year, the stability was attributed to modest buying demand.

While established market players' output levels have stayed basically stable, there is considerable selling pressure as producers give slight discounts to their usual trade associates.

Additionally, the material's future bookings are still on the low side, suggesting that demand may be slowing down. However, a north India-based original equipment manufacturing (OEM) source informed, "Most of the participants expect that alloy ingot demand may rebound in the near term."

The die-casting industry currently needs more capacity utilisation due to introduction of new technologies in the automobile sector. As a result of low usage, the supply chain for components has been impacted.

The latest industry-focused exclusive report by AlCircle, “Global Aluminium Industry Outlook 2023”, unveils that the global aluminium castings usage remained stable in 2022 at a 2021 level of around 21.3 million tonnes. However, the usage is forecast to increase marginally in 2023 to reach 21.8 million tonnes.

Outlook

According to our source, prices for aluminium alloy ingots are projected to remain constant in the foreseeable future, with a potential rebound in demand on the horizon. However, the market may experience conflicts as a result of LME volatility and continuing price decreases by large primary producers of alloy ingots. These variables could make life difficult for the aluminium alloy ingot sector.

Received under the content exchange agreement with SteelMint

Responses