India’s import of ingot grade aluminium products witnessed a surge of 40% M-o-M in May’24

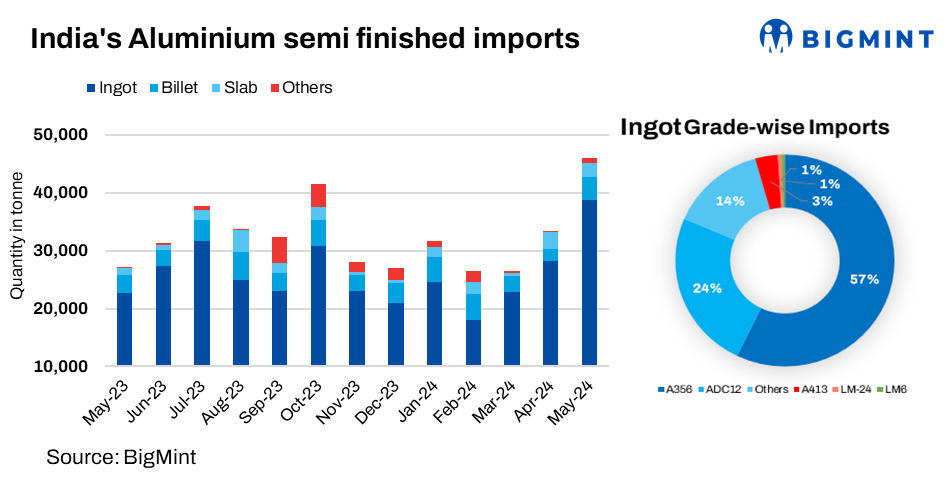

In May 2024, India's imports of ingot grade aluminium products saw a significant increase, rising by 38 per cent M-o-M and 70 per cent compared to the same month the previous year, according to provisional data from BigMint. Specifically, imports of ingots reached 38,700 tonnes, making up 84 per cent of the total aluminium ingot imports.

Significant growth in imports

Image source - BigMint

Billets contributed 3,900 tonnes, or 9 per cent of the total, while slabs accounted for 2,500 tonnes, representing 2 per cent of the total imports. Notably, Indian automobile die casters significantly boosted their imports of ADC12 ingots, which surged by approximately 80 per cent M-o-M in May, reaching 6,500 tonnes compared to 3,700 tonnes in April.

The remaining 32,200 tonnes comprised other grades, including A356, LM6, LM24, and LM25. In India, ADC12 consumption totals approximately 50,000 to 60,000 tonnes. In May, the country imported 6,510 tonnes of ADC12, with the increased imports since March signalling a sudden surge in demand.

Country wise imports

Image source - BigMint

In May, A356 was the most traded alloyed ingot grade, representing about 50 per cent of total alloyed ingot imports. The import volume of A356 rose significantly by 33 per cent month-over-month, reaching 15,453 tonnes. During the same period, India's imports of billets, primarily grade 6082, dramatically increased from 635 tonnes in April to 2,151 tonnes in May. Additionally, the southern region imported the majority of ADC12 in May, totalling 5,410 tonnes, followed by the western region with 947 tonnes and the northern region with 153 tonnes.

Factor driving ADC12 imports

In January, scrap imports declined due to the ongoing crisis in the Red Sea but saw a significant rebound in April and May, driven mainly by delayed shipments booked earlier in the year. These shipment delays caused shortages in scrap stocks within the country, leading to higher domestic and imported scrap prices.

This surge in scrap prices, both globally and domestically, prompted alloy manufacturers to increasingly favour importing alloy ingots, avoiding the higher costs associated with producing ingots from scrap. Furthermore, alloy manufacturers showed increased interest in exploring overseas markets for better price realisation.

Cost-competitive imports from Malaysia

In May, Malaysia exported a substantial amount of ADC12 to Chennai, with increased inflows from Southeast Asian countries compared to April. Reports indicate that over 3,366 tonnes of ADC12 were imported to Chennai during the month.

Additionally, LME aluminium prices rose by 2.7 per cent month-over-month to $2,497 per tonnes, up from the previous month's average of $2,565 per tonnes. This increase contributed to higher prices for imported aluminium scrap, which rose by up to 11 per cent M-o-M. Concurrently, aluminium stocks surged by 75 per cent M-o-M, increasing from 515,908 tonnes in April to 905,513 tonnes in May.

Increased imports of alloy ingots

This trend has spurred alloy manufacturers and some Original Equipment Manufacturers (OEMs) to increase their imports of alloy ingots, particularly from Malaysia, leveraging Free Trade Agreements (FTAs). In Chennai, many ADC12 manufacturers have chosen to import directly.

Sources indicate that the imported price of ADC12 from Malaysia to Chennai is approximately INR 2,12,000 per tonne ($2,540 per tonne). According to BigMint data, the ADC12 price ex-Chennai is around INR 216,000 per tonne, roughly INR 4,000 per tonne higher than the imported price. This price differential significantly motivates buyers to opt for importing materials.

Semi-finished products

In May, the import of semi-finished A356 grade saw a notable increase, rising 34 per cent to 15,373 tonnes from 11,455 tonnes in April. ADC12 grade also showed a significant uptick, jumping 76 per cent to 6,510 tonnes from 3,692 tonnes. LM6 grade experienced a remarkable surge of 420 per cent, reaching 130 tonnes compared to just 25 tonnes in April. Conversely, LM24 grade declined by 33 per cent to 150 tonnes from 224 tonnes the previous month. Other grades collectively decreased by 6 per cent, amounting to 3,805 tonnes in May, down from 4,037 tonnes in April.

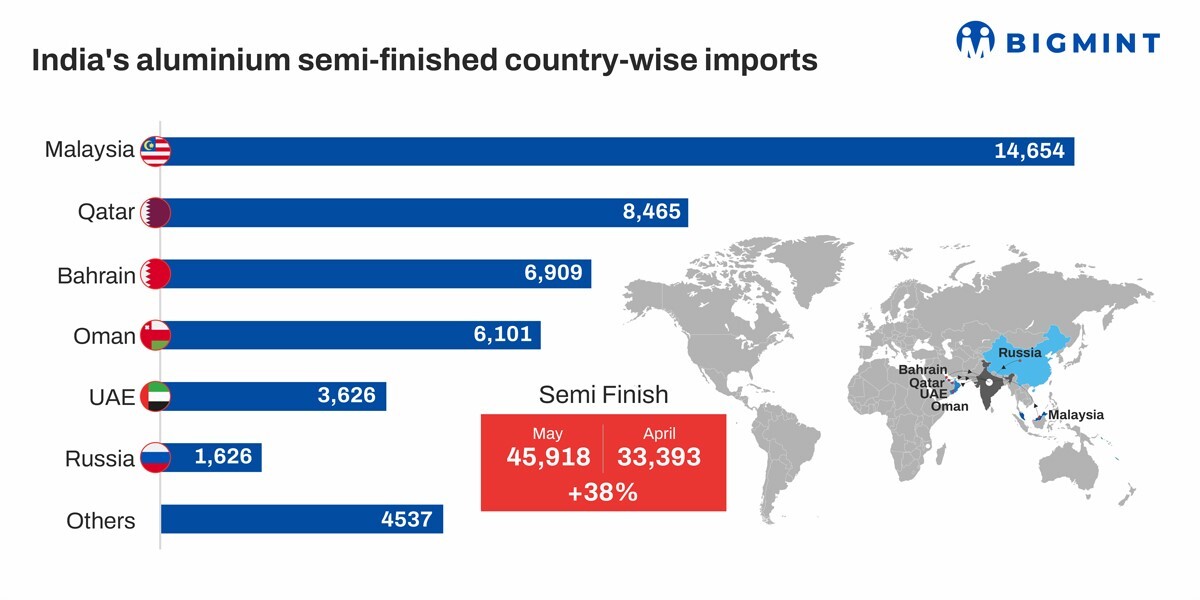

In May, imports by country demonstrated a modest uptick, with Malaysia emerging as the top supplier, followed by Qatar, Bahrain, Oman, UAE, Russia, and other contributors. Specifically, Malaysia led with 14,654 tonnes, followed by Qatar at 8,465 tonnes, Bahrain at 6,909 tonnes, Oman at 6,101 tonnes, UAE at 3,626 tonnes, Russia at 1,626 tonnes, and other countries collectively providing 4,537 tonnes. Imports from additional countries amounted to 1,966 tonnes.

Anticipated projection

There is an expectation of a potential decrease in imports of semi-finished aluminium products in the upcoming months. This projection stems from anticipated easing in scrap imports, which will likely be redirected for domestic use in manufacturing semi-finished products, especially alloy ingots.

sourced from BigMint under the content exchange agreement

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)

.jpg/0/0)