The production of primary aluminium in Japan is no more than 0.5% of the total demand of the nation. In Japan only one aluminium smelter is left out to be operational, however, the country’s per-capita consumption of aluminium has grown to around 16 kg. According to the World Bureau of Metal Statistics, the Japanese production of secondary aluminium in 2020 was around 690.2 thousand tonnes, a downfall of roughly 105.2 thousand tonnes compared to the existing year.

The Japanese semi-finished (plates, sheets & strips) aluminium products market has manifested a significant demand in the overseas market due to its technology proven quality. The East Asian nation, exported 622,555 tonnes of aluminium semi-finished products, attracting earnings of foreign revenue of $1.831 billion from the export.

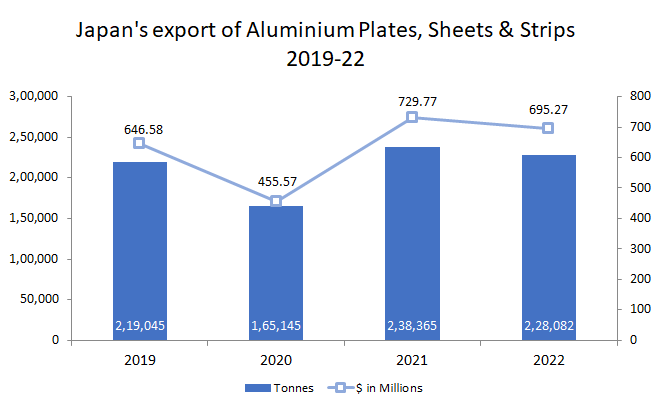

In 2019, Japan exported 219,045 tonnes of aluminium products incurring a revenue inflow of $646.58 million, whereas, in 2020, the country’s export of aluminium semi-finished goods was reported with a massive downfall of 24.60%, primarily due to the Covid-19 pandemic, which created a global demand and supply disruptions, while the earnings also showcased plunge to $455.57 million.

Japan’s export of aluminium semi-finished goods in 2021 reported a rebound in export demand, which illustrated a sharp growth of 31.71%, as the export volume score to 238,365 tonnes, counting revenue generation of $729.77 million.

The export of 2022 has been analysed with a dive of 4.31%, as the export volume is anticipated to descend to 228,082 tonnes and earnings to stand at $695.27 million.

The major trading nations for Japanese export of aluminium semi-finished goods are Australia, Bahrain, Bangladesh, Brazil, Brunei, Canada, China, Germany, Hong Kong, Indonesia, Malaysia, Kuwait, USA, UK, Netherlands, etc.

Responses