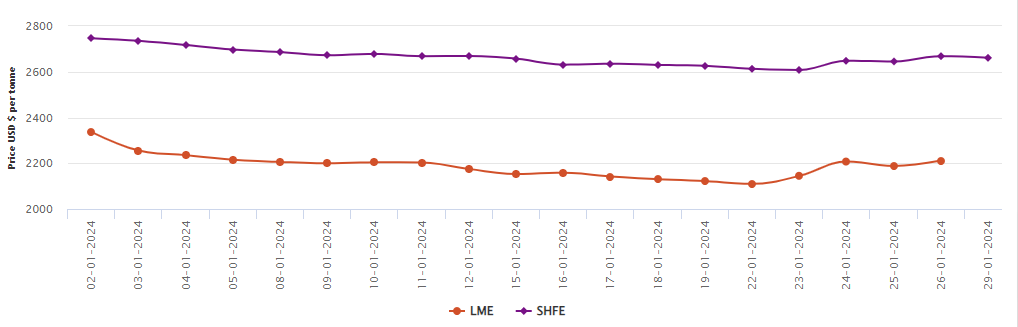

LME aluminium opened at US$2,234.0 per tonne last Friday, with its high and low at US$2,283.0 per tonne and US$2,233.5 per tonne, respectively, before closing at US$2,258.0 per tonne, up by US$26.0 per tonne or 1.16 per cent.

On Friday, January 26, both LME aluminium cash bid price and LME aluminium official settlement price gained US$23.5 per tonne or 1.07 per cent to settle at US$2,211.50 per tonne and US$2,212 per tonne.

LME aluminium 3-month bid price and 3-month offer price ascended by US$21 per tonne or 0.94 per cent and US$20 per tonne or 0.89 per cent to peg at US$2,249 per tonne and US$2,250 per tonne. December 25 bid price and December 25 offer price hiked by US$23 per tonne to reside at US$2,493 per tonne and US$2,498 per tonne.

LME aluminium opening stock came in at 546250 tonnes. Live warrants and Cancelled warrants 346050 tonnes and 200200 tonnes. LME aluminium 3-month Asian Reference Price surged by US$23.14 per tonne or 1.04 per cent to peg at US$2,240.12 per tonne.

SHFE aluminium price

On Monday, January 29, the SHFE aluminium benchmark price has lost US$7 per tonne to reach US$2,661 per tonne. The most-traded SHFE 2403 aluminium contract opened at RMB 19,115 per tonne last Friday night, with its low and high at RMB 19,080 per tonne and RMB 19,250 per tonne before closing at RMB 19,215 per tonne, up RMB 160 per tonne or 0.84 per cent.

Responses