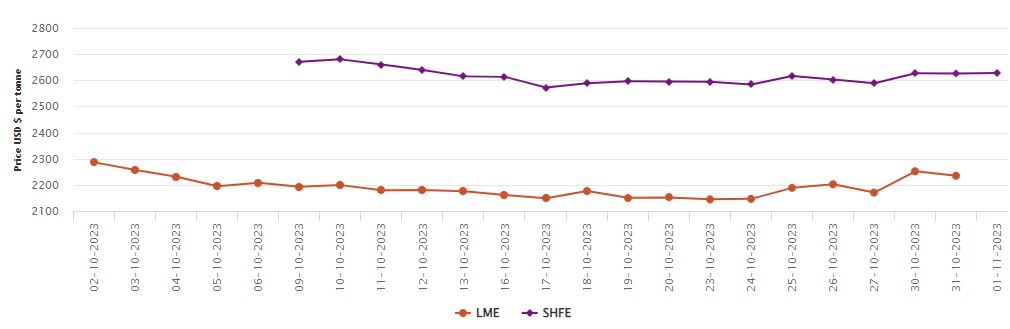

Three-month LME aluminium opened at US$2261.5 per tonne last evening and closed at US$2246 per tonne, a decline of US$17.5 per tonne or 0.77 per cent.

On Tuesday, October 31, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$16.5 per tonne or 0.73 per cent and US$17 per tonne or 0.75 per cent to close at US$2,234.50 per tonne and US$2,235 per tonne.

As per the London Metal Exchange (LME) data, the 3-month bid price and 3-month offer price also fell by US$11 per tonne or 0.48 per cent to clock at US$2,246 per tonne and US$2,247 per tonne. December 24 bid price and December 24 offer price dipped by US$12 per tonne or 0.50 per cent to peg at US$2,360 per tonne and US$2,365 per tonne.

LME aluminium opening stock came in at 474725 tonnes. Live warrants and Cancelled warrants closed at 203800 tonnes and 270925 tonnes.

LME aluminium 3-month Asian Reference Price, on the other hand, gained US$28 per tonne or 1.25 per cent to stop at US$2,258 per tonne.

SHFE aluminium price

Today, on November 1, the Shanghai Futures Exchange (SHFE) aluminium price chart reflected an upward movement of US$2 per tonne or 0.76 per cent to halt at US$2,628 per tonne. The most-traded SHFE 2312 aluminium contract opened at RMB 19215 per tonne in last night's trading session, with the lowest and highest at RMB 19130 per tonne and RMB 19225 per tonne before closing at RMB 19165 per tonne, down RMB 50 per tonne, or 0.26 per cent.

Responses