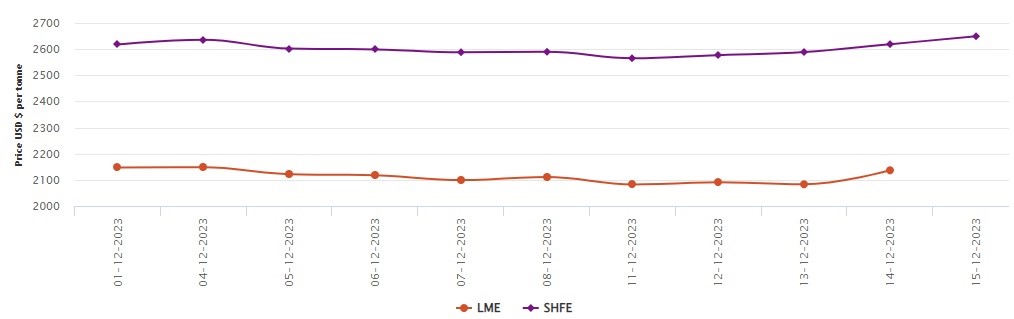

LME aluminium opened at US$2151 per tonne yesterday, with its high and low at US$2220 per tonne and US$2151 per tonne, respectively, before closing at US$2210 per tonne, up US$65 per tonne or 3.03 per cent. On Thursday, December 14, both LME aluminium cash bid price and LME aluminium official settlement price expanded by US$53.5 per tonne or 2.56 per cent and US$54 per tonne or 2.59 per cent to close at US$2,136 per tonne and US$2,137 per tonne.

As per the London Metal Exchange (LME) data, both the 3-month bid price and 3-month offer price surged by US$57 per tonne or 2.68 per cent to settle at US$2,180 per tonne and US$2,181 per tonne. December 24 bid price and December 24 offer price recorded a growth of US$55 per tonne to peg at US$2,298 per tonne and US$2,303 per tonne.

LME aluminium opening stock came in at 447575 tonnes. Live warrants and Cancelled warrants closed at 211525 tonnes and 236050 tonnes. LME aluminium 3-month Asian Reference Price hiked by US$53.33 per tonne or 2.51 per cent to reach US$2,171.14 per tonne.

SHFE aluminium price

The Shanghai Futures Exchange (SHFE) price chart recorded an increase of US$30 per tonne, or 1.14 per cent, today. The SHFE price clocked at US$2,649 per tonne. Overnight, the most-traded SHFE 2401 aluminium contract opened at RMB 18720 per tonne, with its low and high at RMB 18700 per tonne and RMB 18800 per tonne before closing at RMB 18765 per tonne, up RMB 115 per tonne or 0.62 per cent.

Responses