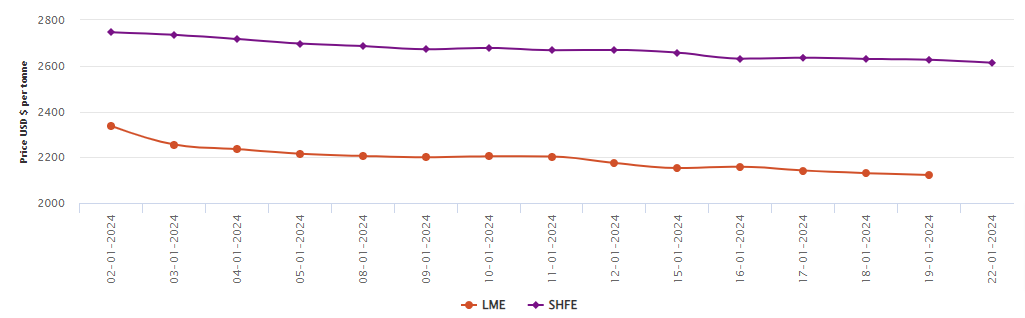

LME aluminium opened at US$2,172 per tonne last Friday, with high and low at US$2,182 per tonne and US$2,158.5 per tonne, respectively, before closing at US$2,172.5 per tonne, an increase of US$4.5 per tonne or 0.21 per cent.

On Friday, January 19, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$9 per tonne or 0.42 per cent and US$8.5 per tonne or 0.39 per cent to stand at US$2,121 per tonne and US$2,122 per tonne.

3-month bid price and 3-month offer price decreased by US$11 per tonne or 0.50 per cent and US$11.5 per tonne or 0.52 per cent to settle at US$2,164 per tonne and US$2,164.50 per tonne. December 25 bid price and December 25 offer price dipped by US$10 per tonne or 0.41 per cent to peg at US$2,420 per tonne and US$2,425 per tonne.

LME aluminium opening stock came in at 555225 tonnes. Live warrants and Cancelled warrants stood at 346125 tonnes and 209100 tonnes. LME aluminium 3-month Asian Reference Price declined by US$23.76 per tonne or 1.08 per cent to arrive at US$2,166.45 per tonne.

SHFE aluminium price analogy

Today, on January 22, the SHFE aluminium price has contracted by US$13 per tonne or 0.49 per cent to come in at US$2,613 per tonne.

Last Friday’s night session, the most-traded SHFE 2403 aluminium contract opened at RMB 18,690 per tonne, with its lowest and highest at RMB 18,630 per tonne and RMB 18,715 per tonne before closing at RMB 18,665 per tonne, up RMB 5 per tonne or 0.03 per cent.

Responses