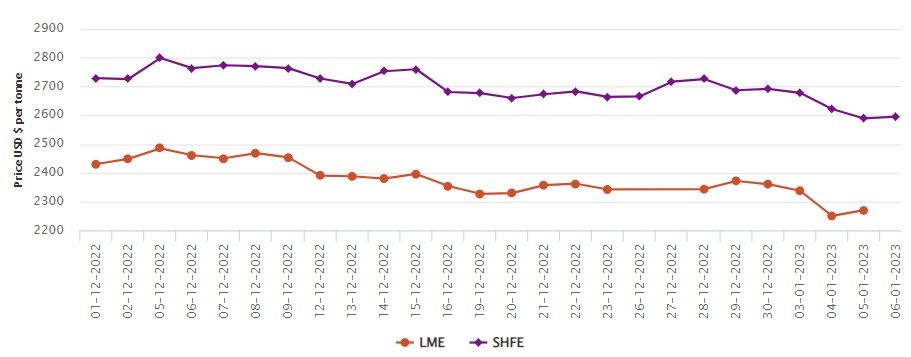

LME aluminium benchmark price gains US$20/t to US$2,270/t; SHFE price drops by US$27/t

LME aluminium opened at US$2,257.5 per tonne on Thursday, with its high and low at US$2,267 per tonne and US$2,255.5 per tonne, respectively, before closing at US$2,256 per tonne, flat from the previous trading day.

On Thursday, January 5, both LME aluminium cash bid price and LME aluminium official settlement price gained US$19 per tonne or 0.84 per cent and US$20 per tonne or 0.88 per cent to stand at US$2,268 per tonne and US$2,270 per tonne.

3-month bid price and 3-month offer price surged by US$17 per tonne or 0.74 per cent to halt at US$2,303 per tonne and US$2,304 per tonne.

December 24 bid price and December 24 offer price were hiked by US$16 per tonne or 0.64 per cent to peg at US$2,493 per tonne and US$2,498 per tonne.

LME aluminium opening stock came in at 436500 tonnes. Live warrants and Cancelled warrants scored at 201350 tonnes and 235150 tonnes.

LME aluminium 3-month Asian Reference Price slumped by US$29.48 per tonne or 1.27 per cent to rest at US$2,280.52 per tonne.

SHFE aluminium price

On Friday, January 6, the SHFE benchmark aluminium price lost US$27 per tonne or 1.02 per cent to score at US$2,595 per tonne.

The most-traded SHFE 2302 aluminium closed down 0.56 per cent or RMB 100 per tonne at RMB 17,905 per tonne, with open interest up 5,850 lots to 172,219 lots.

The most-traded SHFE 2302 aluminium contract opened at RMB 17,950 per tonne overnight, with its high and low at RMB 17,990 per tonne and RMB 17,805 per tonne before closing at RMB 17,815 per tonne, down RMB 90 per tonne or 0.5 per cent.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)