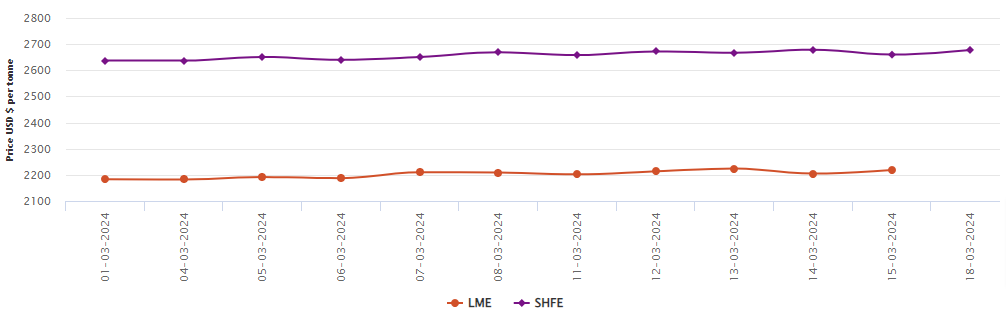

LME aluminium opened at US$2,245 per tonne last Friday, with its high and low at US$2281.5 per tonne and US$2245 per tonne, respectively, before closing at US$2,277 per tonne, up US$21 per tonne or 0.93 per cent.

On Friday, March 15, both LME aluminium cash bid price and LME aluminium official settlement price hiked by US$14 per tonne or 0.63 per cent and US$13 per tonne or 0.61 per cent to settle at US$2,218 per tonne and US$2,218.50 per tonne.

As per the data, both 3-month bid price and 3-month offer price grew by US$16 per tonne or 0.70 per cent and US$16.5 per tonne or 0.73 per tonne to arrive at US$2,270.50 per tonne and US$2,271.50 per tonne.

December 25 bid price and December 25 offer price ascended by US$17 per tonne to settle at US$2,480 per tonne and US$2,485 per tonne. On the same day, LME aluminium opening stock came in at 571775 tonnes. Live warrants and Cancelled warrants closed at 350650 tonnes and 221125 tonnes.

LME aluminium 3-month Asian Reference Price expanded by US$15.98 per tonne or 0.70 per cent to halt at US$2,271.19 per tonne.

SHFE aluminium price

On Monday, March 18, the SHFE aluminium benchmark price hiked by US$18 per tonne or 0.67 per cent to reside at US$2,678 per tonne. At last Friday’s night session, the most-traded SHFE 2404 aluminium contract opened at RMB 19,280 per tonne, with its lowest and highest at RMB 19,225 per tonne and RMB 19,300 per tonne before closing at RMB 19,285 per tonne, down RMB 10 per tonne or 0.05 per cent.

Responses