Three-month LME aluminium opened at US$2,395 per tonne on Monday and closed at US$2,462 per tonne, an increase of US$72 per tonne or 3.01 per cent.

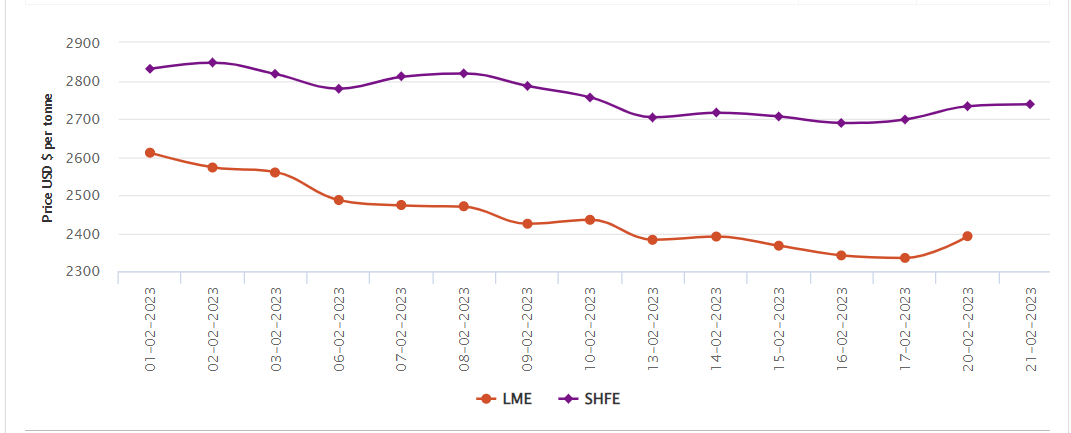

On Monday, February 20, LME aluminium cash bid price and LME aluminium official settlement price skyrocketed by US$55.50 per tonne and US$57 per tonne, respectively, to stand at US$2,390 per tonne and US$2,392 per tonne. That marked an increase after three consecutive days of fall from US$2,391 per tonne on February 14 to US$2,335 per tonne on February 17.

3-month bid price and 3-month offer price surged by US$56 per tonne or 2.36 per cent to clock at US$2,428 per tonne and US$2,430 per tonne. December 24 bid price and December 24 offer price totalled US$2,598 per tonne and US$2,603 per tonne.

LME aluminium opening stock continued to decline by 6,200 tonnes to close at 585,750 tonnes. Live Warrants dipped 150 tonnes to amount to 451,725 tonnes, while Cancelled Warrants plunged 6,050 tonnes to settle at 134,025 tonnes.

LME aluminium 3-month Asian Reference Price stood at US$2,428.31 per tonne, recording an increase of US$30.07 per tonne.

SHFE aluminium price

On Tuesday, February 21, the SHFE aluminium benchmark price has grown by US$5 per tonne or 0.18 per cent to settle at US$2,738 per tonne.

The most-traded SHFE 2303 aluminium contract opened at RMB 18,730 per tonne overnight before closing at RMB 18,775 per tonne, up RMB 220 per tonne or 1.18 per cent.

The most-traded SHFE 2303 aluminium closed up 1.4 per cent or RMB 260 per tonne at RMB 18,775 per tonne, with open interest down 24,322 lots to 129,263 lots.

Responses