LME aluminum opened at US$2,246.5 per tonne last Friday, March 8, with its high and low at US$2,267 per tonne and $2,233.50 per tonne, respectively, before closing at US$2,236 per tonne, down US$16 per tonne or 0.71 per cent.

On Friday, the LME aluminium cash bid and LME aluminium official settlement price slightly dipped by US$1 per tonne to close the week at US$2,208.50 per tonne and US$2,209 per tonne, respectively, following a surge of 1.04 per cent on the previous day.

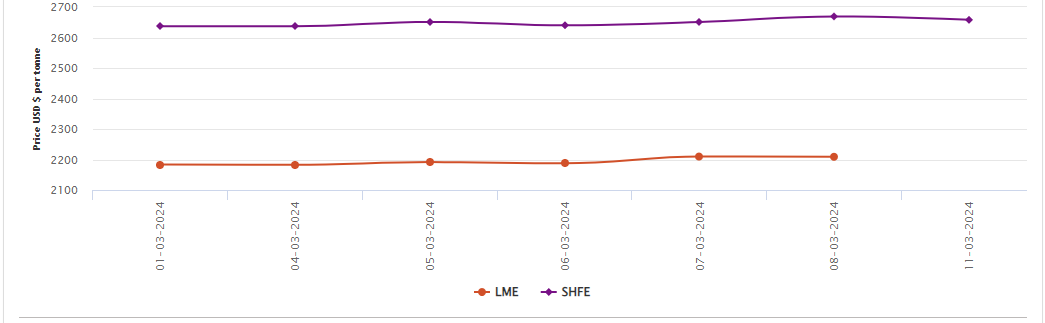

On a week-on-week calculation, the LME aluminium benchmark price concluded on Friday at a higher rate of 1.17 per cent, shows the LME aluminium price chart on AL Circle.

On Friday, amid the LME aluminium price drop, the 3-month bid price and 3-month offer price inched up by US$1 per tonne or US$1.50 per tonne, respectively, to peg at US$2,256 per tonne and US$2,257 per tonne. The December 25 bid price and December 25 offer price also gained US$1 per tonne unanimously to rest at US$2,463 per tonne and US$2,468 per tonne.

On the same day, the LME aluminium opening stock dropped by 275 tonnes, amounting to 580,050 tonnes. Live Warrants and Cancelled Warrants totalled 349,475 tonnes and 230,575 tonnes, respectively. While the former stood restrained, the latter dropped by 275 tonnes.

The LME aluminium 3-month Asian Reference Price increased by 0.76 per cent, reaching US$2,251.79 per tonne.

SHFE aluminium price

On Monday, March 11, the SHFE aluminium benchmark price decreased by US$11 per tonne or 0.41 percent, marking the second consecutive day of rise. Thus, the price stands at US$2,658 per tonne.

On the last Friday night session, the most-traded SHFE 2404 aluminium contract opened at RMB 19,195 per tonne, with its lowest and highest at RMB 19,120 per tonne and RMB 19,225 per tonne, before closing at RMB 19,140 per tonne, down 0.36 per cent.

Responses