Three-month LME aluminium opened at US$2,370 per tonne on Tuesday and closed at US$2,372 per tonne, a decrease of US$4.5 per tonne or 0.19 per cent.

On Tuesday, February 28, the LME aluminium cash bid price and LME aluminium official settlement price again decreased after an intermittent rise on the previous day. While the former dwindled by US$15 per tonne to US$2,298 per tonne, the latter slipped by US$14 per tonne to settle at US$2,300 per tonne.

The 3-month bid price and 3-month offer price shrank by US$13 per tonne and US$14 per tonne, respectively, scoring at US$2,345 per tonne and US$2,346 per tonne. December 24 bid price and December 24 offer price shrivelled by US$27 per tonne to close at US$2,533 per tonne and US$2,538 per tonne as of February 28.

LME aluminium opening stock plunged by 4,475 tonnes to stand at 554,900 tonnes. Cancelled warrants also slumped by 4,475 tonnes to total 111,225 tonnes, while Live warrants remained restrained at 443,675 tonnes.

Meanwhile, LME aluminium 3-month Asian Reference Price grew by US$27.08 per tonne last day, amounting to US$2,361.70 per tonne.

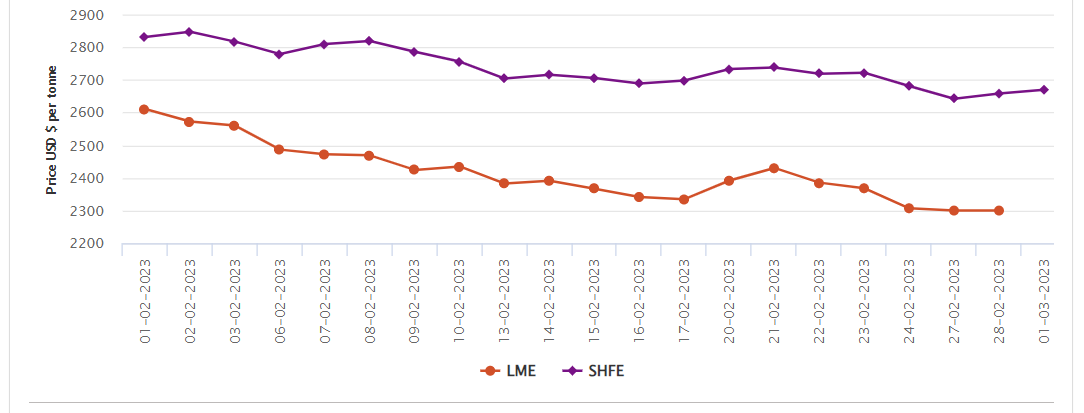

SHFE aluminium price

On Wednesday, March 1, the SHFE aluminium benchmark price further grew by US$12 per tonne to settle at US$2,670 per tonne.

The most-traded SHFE 2304 aluminium contract opened at RMB 18,450 per tonne overnight before closing at RMB 18,435 per tonne, down by RMB 25 per tonne or 0.14 per cent.

The most-traded SHFE 2304 aluminium closed up 0.24 per cent or RMB 45 per tonne at RMB 18,460 per tonne, with open interest down 7,887 lots to 215,358 lots.

Responses