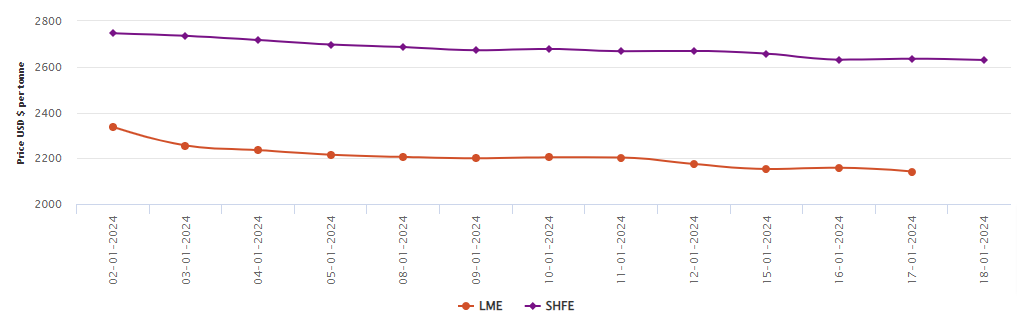

LME aluminium opened at US$2,215 per tonne on Wednesday, with high and low at US$2,217 per tonne and US$2,175 per tonne, respectively, before closing at US$2,176 per tonne, a drop of US$24 per tonne or 1.09 per cent.

On Wednesday, January 17, both LME aluminium cash bid price and LME aluminium official settlement price dropped by US$16.5 per tonne or 0.76 per cent to settle at US$2,141.50 per tonne and US$2,142 per tonne.

LME aluminium 3-month bid price and 3-month offer price slumped by US$16 per tonne or 0.72 per cent and US$17.5 per tonne or 0.79 per cent to peg at US$2,189 per tonne and US$2,189.50 per tonne.

December 25 bid price and December 25 offer price also decreased by US$15 per tonne or 0.60 per cent to arrive at US$2,445 per tonne and US$2,450 per tonne. LME aluminium opening stock arrived at 557675 tonnes. Live warrants and Cancelled warrants settled at 354575 tonnes and 203100 tonnes.

LME aluminium 3-month Asian Reference Price inched up by US$1.12 per tonne or 0.05 per cent to clock at US$2,200.81 per tonne.

SHFE aluminium price analogy

Today, on January 18, the SHFE aluminium price has dipped by US$5 per tonne or 0.18 per cent to rest at US$2,630 per tonne. Overnight, the most-traded SHFE 2403 aluminium contract opened at RMB 18,810 per tonne, with high and low at RMB 18,815 per tonne and RMB 18,730 per tonne before closing at RMB 18,760 per tonne, down RMB 110 per tonne or 0.58 per cent.

Responses