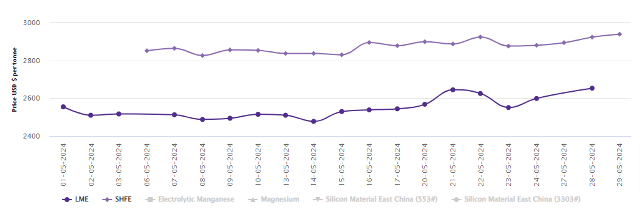

LME aluminium benchmark price surges by US$54/t to US$2,653/t; SHFE price gains US$16/t

LME aluminium opened at US$2,667 per tonne in the previous trading session, reaching a high of US$2,741.5 per tonne, a low of US$2,667 per tonne, and closed at US$2,732 per tonne, up US$74 per tonne or 2.78 per cent.

On Tuesday, May 28, both LME aluminium cash bid price and LME aluminium official settlement price surged by US$54 per tonne or 2.07 per cent to settle at US$2,652 per tonne and US$2,653 per tonne. One of the main reasons for the price hike can be attributed to strong rally in the key raw material alumina and robust demand. Gas shortages prompted mining giant Rio Tinto to declare force majeure on alumina shipments from its Australian refineries, raising concerns about supply from the world's second-largest producer.

As per the LME price graph, 3-month bid price and 3-month offer price expanded by US$54.5 per tonne or 2.05 per cent and US$54 per tonne or 2.03 per cent to halt at US$2,703.50 per tonne and US$2,704 per tonne.

December 25 bid price and December 25 offer price hiked by US$42 per tonne or 1.51 per cent to clock at US$2,810 per tonne and US$2,815 per tonne.

LME aluminium opening stock came in at 1121500 tonnes. Live warrants and Cancelled warrants closed at 652400 tonnes and 469100 tonnes. LME aluminium 3-month Asian Reference Price soared by US$72.07 per tonne or 2.75 per cent to peg at US$2,690.17 per tonne.

SHFE aluminium price

Today, on May 29, the Shanghai Futures Exchange (SHFE) aluminium benchmark price has added RMB 16 per tonne to peg at US$2,939 per tonne. The most-traded SHFE 2407 aluminium contract opened at RMB 21,250 per tonne overnight, reaching a high of RMB 21,300 per tonne, a low of RMB 21,125 per tonne, and closed at RMB 21,205 per tonne, up RMB 20 per tonne or 0.09 per cent.

This news is also available on our App 'AlCircle News' Android | iOS