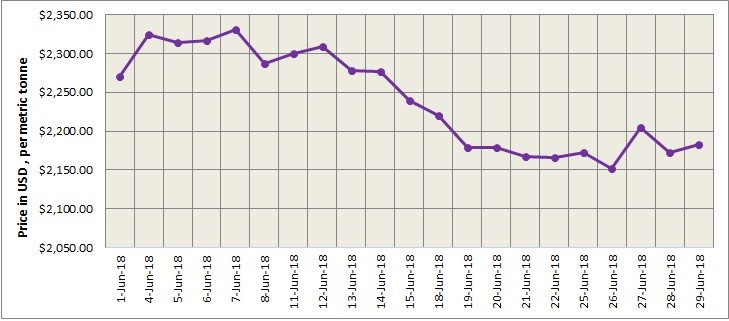

LME base metals saw mixed trading on Friday June 29. LME aluminium broke the support at US$2,150 per tonne and dipped to a low of US$2,130 per tonne last Friday. The metal closed at US$ 2183 per tonne on Friday, June 29, from US$ 2173 per tonne on Thursday June 28.SMM expects it to cease the downward trend today due to expectations of strong purchasing managers’ index (PMI) from several countries. LME aluminium is likely to trade at US$2,122-2,150 per tonne.

As on June 28, LME aluminium cash (bid) price stands at US$ 2182.50 per tonne, LME official settlement price stands at US$ 2183 per tonne; 3-months bid price stands at US$ 2159 per tonne, 3-months offer price is US$ 2160 per tonne; Dec 19 bid price stands at US$ 2183 per tonne, and Dec 19 offer price stands at US$ 2188 per tonne.

The LME aluminium opening stock increased to 1114125 tonnes. Live Warrants totalled at 899950 tonnes, and Cancelled Warrants were 214175 tonne.

LME aluminium 3-months Asian Reference Price is hovering at US$ 2151.09 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 2096 per tonne on July 2 from US$ 2118 per tonne on June 29.

As short positions increased, the SHFE 1808 contract traded rangebound after a low of RMB14,110 per tonne last friday. The contract closed at RMB 14,165 per tonne, down RMB 45 per tonne from Thursday. According to Shanghai Metals Market, declining costs at producers and pressure from fundamentals are the main reasons leading to weak aluminium prices.

SMM expects the SHFE 1808 contract to test support at RMB14,000 per tonne as it was depressed to a low of RMB 14,045 per tonne last Friday night. SMM expects it to trade at RMB 14,000-14,200 per tonne today with spot discount at RMB80-40 per tonne

The US dollar index fell below 95 to close at 94.5 last Friday night, with pressure from a strengthened euro as the European leaders reached a migration deal. Key factor to watch today include China’s Caixin manufacturing PMI, the Markit manufacturing PMI for the US, Eurozone and its countries, and the US ISM manufacturing PMI in June.

Responses