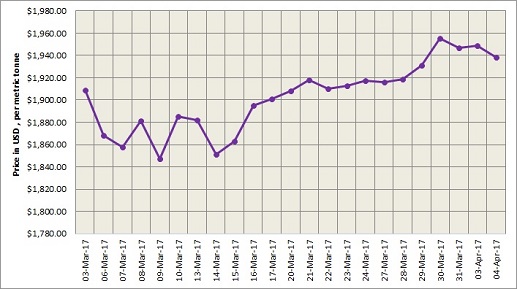

LME aluminium is moving downhill. The light metal which was rallying a week ago dropped 0.53 per cent from its previous close of US$1,948.50 per tonne on Monday, to US$1,938 per tonne on Tuesday, April 4. The decline, Reuters analyses, is not going to be a persisting one. The wave pattern and a Fibonacci projection says LME aluminium may end its current bounce around a resistance at US$1,970 per tonne and then fall towards its April 4 low of US$1,936.

According to Shanghai Metals Market forecast, LME aluminum will rally to the 10-day moving average and move at US$1,922-1,946 per tonne on Wednesday, April 5.

{alcircleadd}

As on April 4, LME official cash buyer price of aluminium stands at US$1,937 per tonne, cash seller & settlement price is US$1,938 per tonne, 3M buyer price is US$1,948 per tonne, 3M seller price is US$1,949 per tonne, Dec1 buyer price is US$1,983 per tonne, and Dec1 seller price is US$1,988 per tonne. The current LME official Opening Stock of aluminium is estimated at 1863050 tonnes, total Live Warrants is 1008125 tonnes, and Cancelled Warrant is 854925 tonnes.

LME aluminium premiums showed slight variation on Tuesday. As on April 3, LME Aluminium US Premium stands at US$215, LME Aluminium West-Europe Premium stands at US$95, LME Aluminium East-Asia Premium has inched higher at US$105 and LME Aluminium South-East Asia Premium is US$15 (per tonne).

{googleAdsense}

The benchmark aluminium price of Shanghai Metal Exchange (SME), as on April 5, stands at US$2,021 per tonne, up 2.79 per cent from its previous stand of US$1,966per tonne on March 31.

Trading resumed at the Shanghai Futures Exchange on Wednesday. Aluminium prices are expected to see range bound trading on the first day after the 2017 Chinese Qingming Festival. SMM predicts, SHFE 1705 aluminium will decline and move between RMB 13,800-14,100 per tonne on Wednesday.

Spot aluminium in China's domestic market should trade at discounts of RMB 200-160 per tonne on Wednesday.

Responses