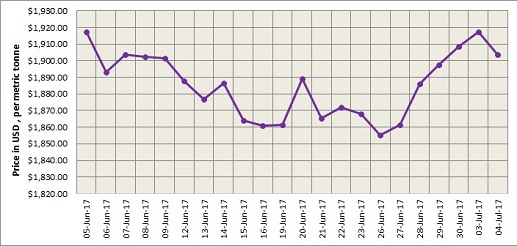

LME aluminium after staging a reversal last Friday, June 30, has been rising at a fairly steady pace, but the uptrend was interrupted by the metal’s drop. After failing to break a resistance at US$1,933 per tonne LME aluminium tested a support at US$1,908 per tonne and bounced back to US$1,903.50 per tonne on Tuesday, July 4, down 0.73 per cent from its previous close of US$1,917.50 per tonne.

Shanghai Metals Market forecasts that LME aluminium will challenge US$1,930 per tonne and range at US$1,915-1,935 per tonne on Wednesday, July 5.

{alcircleadd}

As on July 4, LME official cash buyer aluminium price stands at US$1,903 per tonne, cash seller & settlement aluminium price is US$1,903.50 per tonne, 3M buyer price is US$1,913 per tonne, 3M seller price is US$1,913.50 per tonne, Dec1 buyer price is US$1,947 per tonne, and Dec1 seller price is US$1,952 per tonne. The current LME official Opening Stock of aluminium is estimated at 1402000 tonnes, total Live Warrant is 1069050 tonnes, and Cancelled Warrant is 332950 tonnes.

LME aluminium premium for the US market has dropped from the earlier US$190 to US$180 per tonne. For the remaining regions, LME aluminium premiums remain unchanged. As on July 3, LME Aluminium West-Europe Premium stands at US$80, LME Aluminium East-Asia Premium is US$105, and LME Aluminium South-East Asia Premium is US$15 (per tonne).

{googleAdsense}

The benchmark aluminium price at Shanghai Metal Exchange (SME) has edged higher at US$2,056 per tonne on Wednesday, July 5 from US$2,041 per tonne on Tuesday, July 4.

At Shanghai Futures Exchange (SHFE), the most active aluminium future contract SHFE 1708 aluminium opened at RMB 14,090 per tonne on Tuesday, July 4, and then moved down to touch the intra-day low of RMB 14,005 per tonne in the afternoon. Before closing, the contract rebounded slightly to settle at MB 14,040 per tonne. SMM predicts that SHFE 1708 aluminium will rise further to RMB 14,235 per tonne buoyed by news on output cut in Xinjiang.

Spot aluminium in east China market is expected to trade at discounts of RMB 160-120 per tonne over SHFE 1707 aluminium contract on Wednesday.

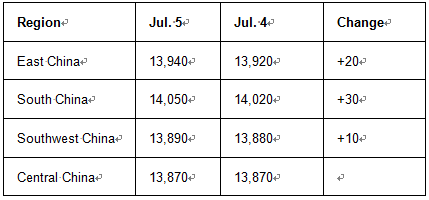

China Aluminum International Trading Co. (Chalco Trading) raised aluminium prices it offered in major markets today. The revised prices are as follows:

Unit: RMB per tonne

The market focus will be on the euro zone’s June service, composite PMI and May retail sales, and US May durable goods orders on Wednesday, SMM said.

Responses