The benchmark aluminium price on London Metal Exchange slipped further from US$2,188.50 per tonne to US$2,172.52 per tonne on Tuesday, February 27, as stocks were available and selling was regular. But finally LME aluminium inventory growth has come to a halt, which means aluminium prices on the bourse will firm up.

Shanghai Metals Market opines that LME aluminium will stay firm in the near term trading at US$2,140-2,167 per tonne on Wednesday, February 28.

{alcircleadd}

As on February 27, LME aluminium cash (bid) price stands at US$2,171.50 per tonne, LME aluminium cash (offer) price stands at US$2,172.50 per tonne; 3-months bid price stands at US$2,146 per tonne, 3-months offer price is US$2,147 per tonne; Dec 19 bid price stands at US$2,198 per tonne, and Dec 19 offer price is US$2,203 per tonne.

The LME aluminium opening stock today stood at 1318375 tonnes, Live Warrants totalled at 1085175 tonnes, and Cancelled Warrants were 233200 tonne.

LME aluminium 3-months ABR price is hovering at US$2,154.36 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched higher from US$2,215 per tonne on February 27 to US$2,220 per tonne on February 28.

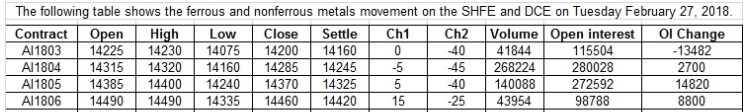

On Shanghai Futures Exchange, aluminium was not able to sustain its rise. SHFE aluminium fell as “investors added to their long bets.” Following is the SHFE aluminium price movement on February 27, as updated by SMM:

As per SMM, SHFE aluminium will regain its upward momentum once destocking starts in the high season and cost of production stabilises further. SHFE aluminium is expected to stay range-bound near its five-day and ten-day moving averages and trade at RMB 14,200-14,400 per tonne range on Wednesday.

Spot discounts on aluminium are expected to be at RMB 220-180 per tonne today.

Responses