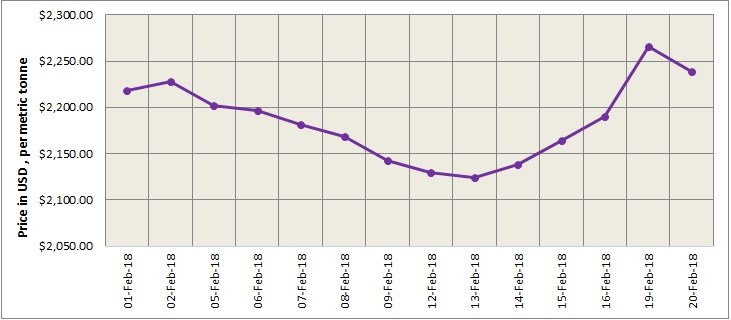

Benchmark aluminium price on London Metal Exchange dropped marginally on Tuesday, February 20, as trading remained mostly muted during Asian morning trading hours. The light metal contract closed at US$2,239 per tonne, down from US$2,266 per tonne on Monday, February 19.

After the US Commerce Department’s recommendation on the imposition of tariffs and quotas on aluminium (and steel), LME base metal prices are expected to ease a bit. However, knee-jerk reaction amid uncertainty caused may again lift LME aluminium prices in the short term.

As on February 20, LME aluminium cash (bid) price stands at US$2,238.50 per tonne, LME aluminium cash (offer) price stands at US$2,239 per tonne; 3-months bid price stands at US$2,205 per tonne, 3-months offer price is US$2,206 per tonne; Dec 19 bid price stands at US$2,242 per tonne, and Dec 19 offer price is US$2,247 per tonne.

LME aluminium opening stock is recorded at 1308525 tonnes, Live Warrants total at 1147000 tonnes, and Cancelled Warrants stand at 161525 tonne.

LME aluminium 3-months ABR price is US$2,204.50 per tonne.

China market still remains closed for the Lunar New Year Holiday.

Responses