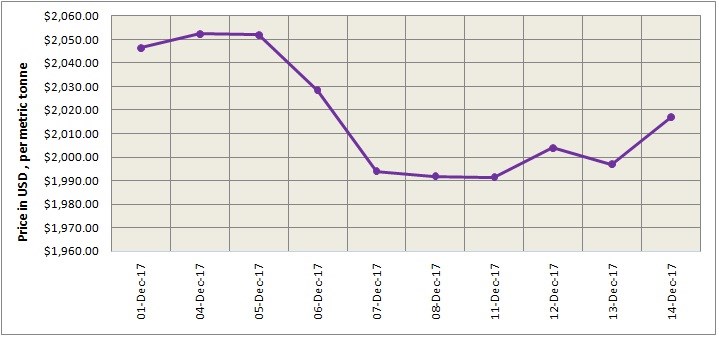

A falling US dollar index and China’s November aluminium output data lifted LME aluminium prices above the US$2,000 per tonne mark on Thursday, December 14. Despite higher inventory level, the light metal contract rose from US$1,997 per tonne on Wednesday, December 13, to close at US$2,017 after night trading yesterday.

Shanghai Metals Market (SMM) analysis suggests LME aluminium will continue to be range-bound at the 10-day moving average at US$2,028-2,065 per tonne on Friday, December 15.

{alcircleadd}

As on December 14, LME official cash buyer aluminium price (Bid Price) stands at US$2,015 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,017 per tonne, 3M Bid Price is US$2,033 per tonne, 3M Offer Price is US$2,033.50 per tonne, Dec1 Bid Price is US$2,078 per tonne, and Dec1 Offer Price is US$2,083 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1110600 tonnes, total Live Warrants is 889450 tonnes, and Cancelled Warrant is 221150 tonnes.

SME and SHFE Aluminium price trend

The benchmark aluminium price at Shanghai Metal Exchange (SME) has risen from US$2,115 per tonne on Thursday, December 14, to US$2,126.89 per tonne on Friday, December 15.

The main aluminium contract on Shanghai Futures Exchange (SHFE) is hovering at the 5-day moving average. SMM predicts that SHFE aluminium may trade at RMB 14,280-14,550 per tonne range on Friday, December 15. Spot discount will keep steady at RMB 130-90 per tonne.

The market needs to watch out for the key indicators like US manufacturing data and unemployment figures today, SMM said.

Responses