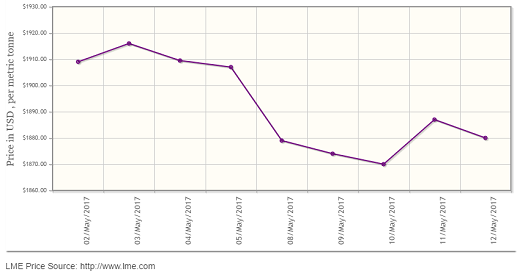

LME aluminium gave up its marginal gain last week and dropped to US$1,880 per tonne after night trading on Friday, May 12. The 0.37 dip was caused due to oversupply issues looming large over global aluminium market. According to Shanghai Metals Market (SMM), LME aluminium will perform better this week but not “as well as” aluminium traded at the Shanghai Futures Exchange (SHFE). SMM foresees LME aluminium trading mainly in the range of US$1,870-1,900 per tonne on Monday, May 15.

As on May 12, LME official cash buyer price of aluminium stands at US$1,879 per tonne, cash seller & settlement price is US$1,880 per tonne, 3M buyer price is US$1,883 per tonne, 3M seller price is US$1,884 per tonne, Dec1 buyer price is US$1,923 per tonne, and Dec1 seller price is US$1,98 per tonne. The current LME official Opening Stock of aluminium is estimated at 1556150 tonnes, total Live Warrants is 968475 tonnes, and Cancelled Warrant is 587675 tonnes.

LME aluminium premiums, as on May 11, remain unchanged across major regions. LME Aluminium East-Asia Premium stands at US$110, LME Aluminium US Premium is US$215, LME Aluminium West-Europe Premium is US$95, and LME Aluminium South-East Asia Premium remains unchanged at US$15 (per tonne).

{googleAdsense}

The benchmark aluminium price at Shanghai Metal Exchange (SME) has risen at US$2,009 per tonne on Monday, May 12, up 1.2 per cent from the benchmark aluminium price of US$1,985 per tonne on Friday, May 12.

SMM predicts that SHFE 1707 aluminium will test support at the 10-day moving average and range at RMB 13,800-14,000 per tonne on Monday. The “rumours” surrounding Shandong releasing its detailed implementation program for illegal and outdated capacity cuts shortly are helping the contracts gain strength in the foreseeable future.

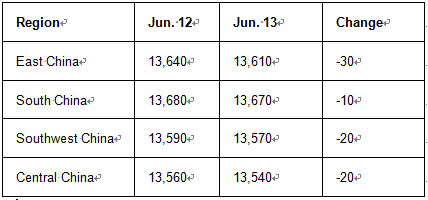

China Aluminum International Trading Co. (Chalco Trading), on other hand has significantly raised aluminium prices it offered in major markets on Monday, May 15.

The price details are as follows:

Unit: yuan/tonne

SMM says, the market focus today will be on China’s investment during January-April, consumption and value added at industrials, New York Fed’s manufacturing index and NAHB’s Housing Market Index (HMI) data that are scheduled for release on May 15.

Responses