The US dollar and bond yields rose on Friday as the United States said it was close to finalizing parts of a trade deal with China. The dollar index, which tracks the greenback against a basket of other currencies, was up 0.62% for the week with a rise of 0.17% last Friday, ending at 97.83. LME base metals closed mixed while the SHFE complex traded higher across the board. LME aluminium gained 0.99% and SHFE aluminium grew 0.25%.

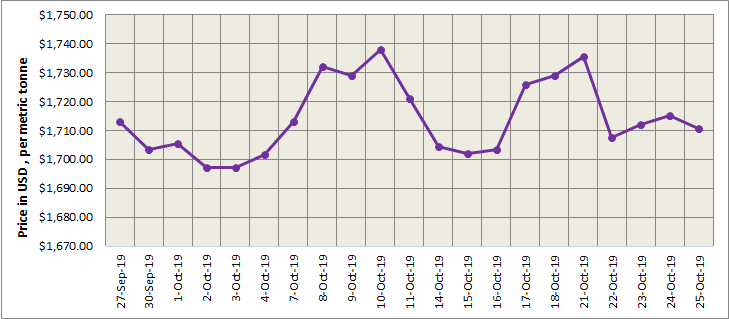

LME aluminium closed the day lower on last Friday but gained during night trading. Three-month LME aluminium outperformed most of the other base metals as it closed at the highest level last Friday night at US$1,734 per tonne, up 0.99% on the day. LME aluminium is likely to trade at US$1,705-1,740 per tonne.

As on October 25, Friday, LME aluminium cash (bid) price stood at US$ 1710 per tonne, LME official settlement price stands at US$ 1710.50 per tonne; 3-months bid price stands at US$ 1719 per tonne, 3-months offer price is US$ 1720 per tonne; Dec 20 bid price stands at US$ 1805 per tonne, and Dec 20 offer price stands at US$ 1810 per tonne.

The LME aluminium opening stock dropped to 966200 tonnes. Live Warrants totalled at 791775 tonnes, and Cancelled Warrants were 174425 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1721.61 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) has increased to USD 2002 per tonne today, 28 October 2019.

The most traded SHFE 1912 contract dropped to an intraday low of RMB 13,775 per tonne during the day, before it recouped some losses to end a tad weaker at RMB 13,805 per tonne last Friday. The December contract then climbed on short-covering, ending higher at RMB 13,850 per tonne during Friday night. Trading range today is expected at RMB 13,750-13,850 per tonne.

It is expected to remain rangebound in the short term, supported by falling inventories but weighed by prospects for weaker consumption in the long term.

Responses