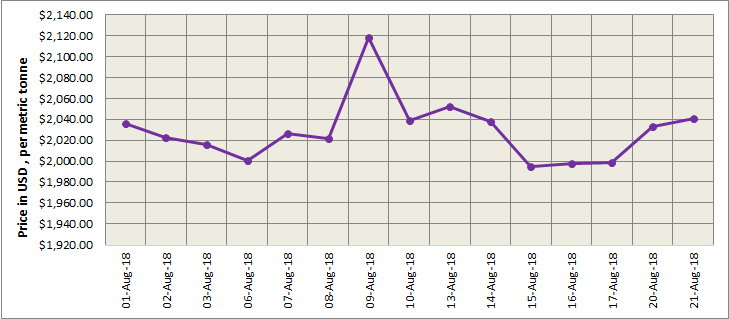

The dollar weakened on Tuesday after US President Donald Trump criticised central bank's interest rate hikes. The dollar index settled at 95.238 after it fell to 95.07, its lowest since August 9. LME aluminium closed the day’s trading at US$ 2040.50, higher than last closing and later strengthened to finish Tuesday at US$2,064.5 per tonne overnight. The contract is expected to trade at US$2,060-2,080 per tonne today.

As on August 21, LME aluminium cash (bid) price stands at US$ 2040 per tonne, LME official settlement price stands at US$ 2040.50 per tonne; 3-months bid price stands at US$ 2064 per tonne, 3-months offer price is US$ 2065 per tonne; Dec 19 bid price stands at US$ 2108 per tonne, and Dec 19 offer price stands at US$ 2113 per tonne.

The LME aluminium opening stock dropped to 1108525 tonnes. Live Warrants totalled at 832525 tonnes, and Cancelled Warrants were 276000 tonne.

LME aluminium 3-months Asian Reference Price is hovering at US$ 2072.46 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased to US$ 2132 per tonne on August 22, from US$ 2127 per tonne on August 21.

As overseas shortages of alumina grew confidence in long positions, the SHFE 1810 contract tested the RMB 14,685 per tonne level twice in the morning yesterday. As longs continued to surge in the afternoon, it jumped to a high of RMB 14,740 per tonne, and closed at RMB 14,705 per tonne. The contract regained losses from last Thursday. The contract rose to close at RMB 14,710 per tonne overnight with open interests up 20,802 lots to 284,000 lots. We expect it to trade at RMB 14,600-14,800 per tonne today with spot discounts of RMB 80-40 per tonne.

Market participants should monitor US weekly crude oil inventory data from the Energy Information Administration (EIA), August meeting minutes of the Fed and US-China trade talks.

Responses