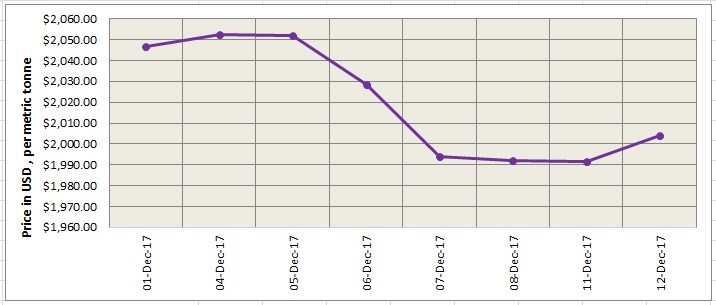

LME aluminium is resisting the downward trend trying to settle over USD 2000. After trending downwards for the last week, the light metal finally crossed USD 2000 level and closed at USD 2004 per tonne on Tuesday December 13. According to SMM, LME aluminium is expected to stay volatile at a low level between $2,000-2,300/t today.

Technical analysis suggests that LME aluminium may break the five-day moving average and trade in the range of US$2,015-2,045 per tonne.

As on December 12, LME official cash buyer aluminium price (Bid Price) stands at US$ 2003per tonne, cash seller & settlement aluminium price (Offer price) is US$ 2004 per tonne, 3M Bid Price is US$2,026 per tonne, 3M Offer Price is US$2,026.50 per tonne, Dec1 Bid Price is US$2,073 per tonne, and Dec1 Offer Price is US$2,078 per tonne.

According to a Platts update London Metal Exchange aluminium stocks on December 8 posted the first increase since November 15 globally, due to more stocks in Port Klang warehouses in Malaysia. Total LME aluminium opening stocks across 32 locations worldwide stood at 1103325 tonnes today, up from 1097425 tonne a day earlier. Total Live Warrants is 879800 tonnes, and Cancelled Warrant is 223525 tonnes.

Global LME aluminium inventory stood at 4 million tonnes at the beginning of the year and plunged on the back of strong US demand, leading to huge metal withdrawal especially in Asia, which was shipped to the US. High US premium levels of around $100/t also drove this increase in shipment to the U.S. The LME warehouses in the US would not experience a major increase in stocks on the back of strong demand, and Asia is likely to see an increase due to a supply glut from China.

According to SMM morning update, the most liquid SHFE aluminium contract is likely to move in the rage of RMB 14,060-14,300/t with a potential downward pressure. Spot market may see discounts narrowed to RMB 120-80/t.

Responses