LME aluminium inches higher in week ending Sept 29, but may fall below US$2,100/t

LME aluminium is under moderate pressure as US Dollar index is still on an upward track. The light metal contract closed at US$2,110.50 per tonne on Friday, September 29, up from US$2,102 per tonne on Thursday, September 28. Reuters’ technical analysis suggests that LME aluminium may break a support at US$2,103 per tonne and drop further in the range of US$2,068-$2,081 per tonne in the short term. A bounce from the current level could be limited to US$2,125 per tonne.

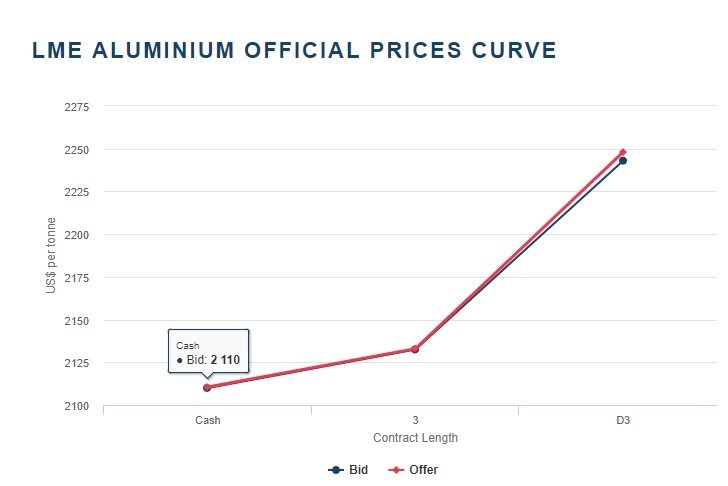

Source:www.lme.com

As on September 29, LME official cash buyer aluminium price (Bid Price) stands at US$2,110 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,110.50 per tonne, 3M Bid Price is US$2,132.50 per tonne, 3M Offer Price is US$2,133 per tonne, Dec3 Bid Price is US$2,243 per tonne, and Dec3 Offer Price is US$2,248 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1268700 tonnes, total Live Warrants is 1001000 tonnes, and Cancelled Warrant is 267700 tonnes.

SME and SHFE Aluminium Price Trend

The weekly average aluminium price estimated by Shanghai Metals Market (SMM) dropped in the week ending September 29 at RMB 16,162 per tonne, down RMB 152 per tonne. SMM monthly average aluminium price rose by RMB 599.07 per tonne or 3.84 per cent to RMB 16,194.29 per tonne.

Base metals barring SHFE aluminium traded at the Shanghai Futures Exchange (SHFE) closed with gains on Friday, September 29. SHFE aluminium finished slightly lower on the last trading day before Chinese National Day and Mid-Autumn holidays which fall on October 1-8 as 2017. Trading will resume on October 9, SMM updated.

Analysts recommend that market participants to wait and see with short positions for SHFE aluminium. They need to focus on industrial news at the international circuit and the trend of LME aluminium.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)