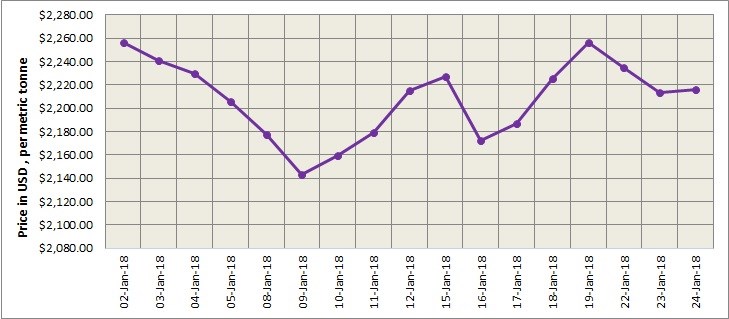

LME aluminium inches up after testing support at US$2,250/t

The upward momentum in LME aluminium prices has slowed down. The light metal put up a poor performance yesterday in comparison with other base metals and closed marginally up at US$2,216 per tonne after testing support at US$2,250 per tonne on Wednesday, January 24.

LME aluminium has fallen by 1.9 per cent since it reached its monthly highest at US$2,256 per tonne in January this year.

Shanghai Metals Market (SMM) predicts that LME aluminium will trade at US$2,215-2,260 per tonne range on Thursday, January 25.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has risen from US$2,257 per tonne on January 24 to US$2,302 per tonne on January 25.

On Shanghai Futures Exchange, open interest on aluminium contracts went down yesterday to 759,552 lots- the lowest recorded since August 2017, as positions for longs got closed amid a risk-avoiding scenario.

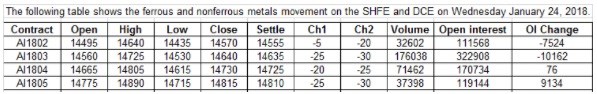

The movement of SHFE aluminium on January 24, as updated by SMM is as follows:

SMM is unable to give any clear direction for the market and investors too seem to be reluctant to active purchasing. However, SHFE aluminium is expected to trade at RMB 14,600-14,800 per tonne on Thursday, January 25.

In the spot aluminium market, discounts are expected to move at RMB 160-120 per tonne today.

This news is also available on our App 'AlCircle News' Android | iOS