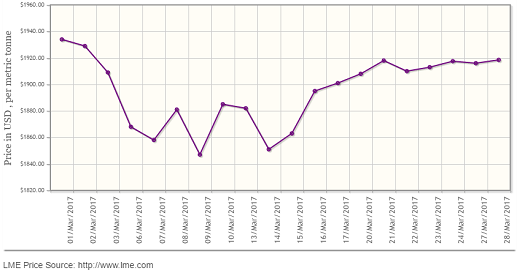

LME aluminium is back to where it was a week ago. At US$1,918 per tonne after Tuesday's night trading, the contract has inched higher from its previous close of US$1,916 per tonne on Monday but remains at the same level where it was seven days back. The news about the US President Donald Trump signing the administrative order to launch a new time of energy industry and employment on Tuesday night seems to have boosted the market sentiment. OPEC's decision to extend oil output cut has also added to the cheer. The decision is likely to support crude oil and aluminium prices.

However, Reuters believes LME aluminium will test a support at US$1,856 per tonne over the next three months, a break below which could cause a further drop to the next support at US$1,775. In the short term, LME aluminium is expected to test US$1,950 per tonne and move between US$1,935-1,955 per tonne on Wednesday, March 29, SMM says.

{alcircleadd}

As on March 28, LME official cash buyer price of aluminium stands at US$1,918 per tonne, cash seller & settlement price is US$1,918.50 per tonne, 3M buyer price is US$1,928 per tonne, 3M seller price is US$1,928.50 per tonne, Dec1 buyer price is US$1,963 per tonne, and Dec1 seller price is US$1,968 per tonne. The current LME official Opening Stock of aluminium is estimated at 1923300 tonnes, total Live Warrants is 1045400 tonnes, and Cancelled Warrant is 877900 tonnes.

As on March 27, LME Aluminium US Premium remains unchanged at US$215, LME Aluminium West-Europe Premium stands at US$95, LME Aluminium East-Asia Premium is US$100 and LME Aluminium South-East Asia Premium is US$15 (per tonne).

{googleAdsense}

The benchmark price of aluminium on Shanghai Metal Exchange (SME) has also increased in tandem with the LME aluminium price. As on March 29, the price stands at US$1,963 per tonne, up 0.66 per cent from the previous day's price of US$1,950 per tonne.

SHFE 1705 aluminium traded on Shanghai Futures Exchange (SHFE) opened at RMB 13,680 per tonne on Tuesday and then dipped marginally down at RMB 13,630 per tonne. As per SMM forecast, the contract is estimated to move at RMB 13,700-13,900 per tonne on Wednesday.

Spot aluminium in China's domestic market should trade at discounts of RMB 170-130 per tonne on Wednesday, says SMM.

Responses