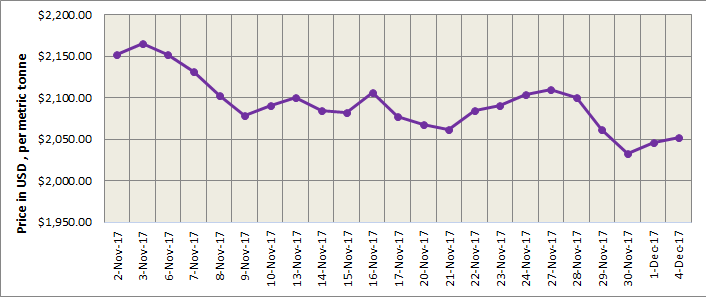

LME aluminium edged higher on Monday, November 4, after closing at US$2,046.50 per tonne on Friday, December 1. The light metal contract ended at US$2,052.50 per tonne yesterday. Analysts revised up their aluminium price forecast in Citi Annual Commodities Market Outlook 2018. They say LME aluminium prices will remain well above US$2,000 per tonne range in the medium term. Overall aluminium production cost will remain higher for longer supporting aluminium prices globally.

As on December 4, LME official cash buyer aluminium price (Bid Price) stands at US$2,052 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,052.50 per tonne, 3M Bid Price is US$2,070 per tonne, 3M Offer Price is US$2,070.50 per tonne, Dec1 Bid Price is US$2,118 per tonne, and Dec1 Offer Price is US$2,123 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1104550 tonnes, total Live Warrants is 872175 tonnes, and Cancelled Warrant is 232375 tonnes.

The benchmark aluminium price at Shanghai Metal Exchange (SME) has jumped from US$2,149 per tonne on Monday, December 4, to US$2,179.00 per tonne on Tuesday, December 5.

According to Shanghai Metals Market forecast, SHFE Aluminium will keep volatile today moving in the range of RMB 14,500-14,830 per tonne under weighed on by 5-day moving average. Spot aluminium premium is expected to range between (discounts) RMB 180-140 per tonne.

Responses