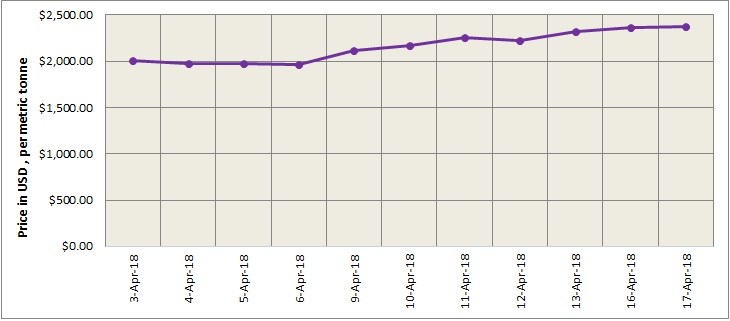

Benchmark aluminium price on London Metal Exchange increased further to close at US$2375.5 per tonne on Tuesday, April 17, up from the previous day's close at US$ 2358.50 per tonne. According to Shanghai Metals Market, LME aluminium rebounded and closed at US$2,411 per tonne after it dipped to a low of US$2,346 per tonne as the ZEW eurozone economic sentiment indicator fell short of expectations overnight. SMM expects it to remain at high levels in the short run due to US sanctions on Rusal. The contract will trade in the range of US$2,389-2,470 per tonne today.

As on April 17, LME aluminium cash (bid) price stands at US$ 2375 per tonne, LME official settlement price stands at US$ 2375.50per tonne; 3-months bid price stands at US$2371.50 per tonne, 3-months offer price is US$ 2372 per tonne; Dec 19 bid price stands at US$ 2325 per tonne, and Dec 19 offer price stands at US$ 2330 per tonne.

The LME aluminium opening stock has increased to 1412400 tonnes. Live Warrants totalled at 1053900 tonnes, and Cancelled Warrants were 358500 tonne.

LME aluminium 3-months ABR price is hovering low at US$2426.94 tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased from US$ 2341 per tonne on April 17 to 2343 per tonne on April 18.

According to SMM, Buoyed by LME aluminium, SHFE aluminium also gained overnight. SHFE is likely to test resistance at RMB 15,000 per tonne and trade at RMB 14,800-15,000 per tonne today. Spot discounts are seen at RMB 70-30 per tonne.

The US dollar is expected to remain weak while base metals are likely to trade rangebound during the day

Responses