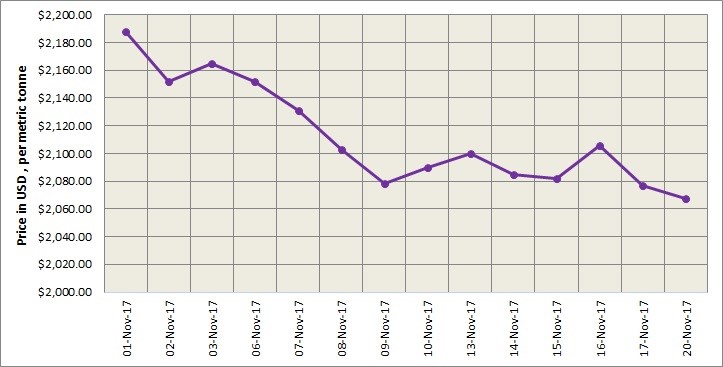

LME aluminium is extending its declines. With the downward tendency of alumina and coal prices already setting in across China market, the light metal is unable to draw support and reverse the downtrend. From US$2,077 per tonne on November 17, LME aluminium has dropped further to US$2,067.50 per tonne after night trading on Monday, November 20.

LME aluminium stocks are falling in tandem as well. This could affect regional aluminium premiums and spreads, market sources opine. Most of the global participants are of the view that there was room for further fall for LME aluminium in the near term.

{alcircleadd}

As on November 20, LME official cash buyer aluminium price (Bid Price) stands at US$2,067 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,067.50 per tonne, 3M Bid Price is US$2,081.50 per tonne, 3M Offer Price is US$2,082 per tonne, Dec1 Bid Price is US$2,128 per tonne, and Dec1 Offer Price is US$2,133 per tonne. LME aluminium Opening Stock or the LME aluminium inventory level stands at 1150875 tonnes, total Live Warrants is 911050 tonnes, and Cancelled Warrant is 239825 tonnes.

Spot price against 3-month LME aluminium futures price ranged at US$17.25 per tonne on November 20, and US$17.5 per tonne on November 17.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has dropped from US$2,272 per tonne on November 20, to US$2,241 per tonne on November 21.

In China domestic market, average aluminium price on Shanghai Futures Exchange is wandering around RMB 15,000 per tonne, but the support of this point does not seem to be strong. SHFE aluminium is estimated to move within the range of RMB 14,950-15,150 per tonne on Tuesday, November 21. Aluminium spot price is expected to move between RMB 140-100 per tonne discount, SMM said.

Responses